Table of Contents

An update:

Thinking about religion things. Sorta complicated topic!

Unfortunately, money is an easier topic to make progress on. Some uncommon favorites of mine:

Stuff vs. Life

Your time to financial independence / retirement can be derived from only your savings rate!

Depending on the situation, not getting seemingly insignificant luxuries like a new car + collision insurance, cable tv, or the frequent latte could save you from years of working!

- And I should clarify. It's not that you don't have a car or entertainment or lattes, it's that you see how much marginal utility they are giving you relative to their cheaper alternatives, such as a $10K used car, netflix or walking and talking with people, and making that delicious latte yourself at home!

- See: https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/ and a hypothetical two-teacher salary becoming FI in <15 years. https://www.mrmoneymustache.com/2011/09/17/the-race-to-retirement-revisited/

This leads to interesting questions like: “Do I really want to trade <X> weeks/years of my life for <Y>“?

Note: There are more optimizations/hazards to this. See other MMM posts for the high-level advice or for the complicated details, see ERN: https://earlyretirementnow.com/2017/11/01/shockingly-simple-complicated-random-math-behind-early-retirement/.

Credit Card Churning

The process of opening credit card accounts for the sole purpose of getting the signup bonuses, and then moving onto the next credit card.

See https://www.choosefi.com/009-travel-rewards-travel-world-free-ultimate-guide/ for a great intro, summarized below with extra notes by me:

- Will hurt a perfect 850 credit score, but from what I read as long as you stay above ~760 (easy to do) it looks like banks don't care for determining your mortgage rate. However, one should double check this (I haven't) and stop churning well ahead of time if needed.

- Keep your old cards! Average Age of Accounts seems my biggest barrier to getting past 780. One might consider starting teenagers with building their credit score on a secured card (kind of like a debit card). It's a difficult tradeoff between opening the door to debt/impulse spending and improving your mortgage rates and signup bonus opportunities in the far future.

- It is untaxed because it's counted as a “coupon” for purchases you made.

- Takes a few hours of research at the beginning to learn about the process, and about 15 minutes to apply for the card. If you want to further optimize, that of course takes more time. Must be somewhat disciplined so you pay off fully every month or utilize 0% intro APR, etc.

- Also make sure to read the fine print of the conditions of the spend.

- I find it easier to make the big tax payment on the signup bonus cards rather than everyday purchases as returned items often get confused with credit card payments in a spreadsheet but subtract from your minimum spend. <speaking from experience!>

- <Bank> The first direct deposit was required to be $500, and I had done 2 bi-weekly direct deposits totaling $500 in the first month. Didn't get the signup bonus

- The $500 annual fee cards with tons of travel-oriented benefits and lots of blogger buzz because of ~$100 referral commissions often have bad (1%) cash back beyond the signup bonus. You're probably better off using a different card for normal spending if you're not planning on traveling or paying the annual fee

. You can usually transfer the points to a lower annual fee card, but I haven't tried or looked into that yet.

. You can usually transfer the points to a lower annual fee card, but I haven't tried or looked into that yet.

- You do get more for your rewards if you redeem them for travel (flights, hotels, probably not hostels though). However if you're like me and would rather take longer vacations sooner (FI), getting unused miles/rewards in cash seems worth it.

- Additionally, if you're married you can apply for the cards separately and get double the card bonuses. Scores and rewards are separate, even if your expenses are joint.

- If you're a small business owner with expenses, then those can go on a special business credit card too. In addition to all the other business expense deductions one can claim.

- Potential benefits are $500 tax-free cash (or more for miles) per card for $3-4K of spending in 3 months for each card, to a limit of 5 good <Chase> cards in 24 months, per person. Not bad, but it might not be worth your time either. YMMV.

- Ethics: Not sure on this one.

- If someone wants to give you money in the hopes that you screw up and you don't screw up, is accepting the money ok? Probably?

- The indebted / debit / cash payers are the ones really paying for your bonus, so make a point of being thankful and giving back?

- If you run out of credit cards to churn, the Federal debit card fee is only ~$2.50 for any amount. Discover has a 1% cash back debit card, and other cards have temporary promotions. Oregon has the normal 2% fee, so this isn't beneficial over just a normal EFT.

More notes for presentation

- Most of this will be review for those familiar. For those unfamiliar, I will try to distill the main details and the thought process down.

- I am definitely not the first Money Matters person to talk about this. Maybe collaborate with Mike Chan or others on reviewing the presentation?

- It feels weird because everyone on the mailing list got the emails about it already. But, maybe a succinct hook with a presentation will be helpful for those not motivated before.

- At some point harvesting won't be worth your limited time. But for most folks I think it's worth the tradeoff.

- I am drawn towards it and tax optimization because it's a solvable, guaranteed return on <time> investment, unlike most other investing or life topics.

Increasing The Amount You Can Charge on a Credit Card (Spend)

- Timing applications with big purchases

- Buying and reselling gift cards (I don't really care for this one)

- Paying quarterly estimated tax payments. For me, 20% of my income! That's huge. See below…

Sorta-Quarterly Estimated Tax Payments

The basic idea is that you tell your employer to not withhold money to pay your taxes, and instead you withhold and pay it yourself with a credit card.

Timing / Periods

It's not every quarter!” Spring is 2 months and winter is 4 months. Odd

- This one is a little tricky if you have a limited cash flow. I made an adjustable spreadsheet to simulate this: Quarterly Estimated Taxes Cashflow Spreadsheet

- Feel free to clone it and adjust the numbers for yourself!

Legality

Apparently some states don't let you do this? But Federal and Oregon are ok with it.

Federal

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. There are two ways to pay as you go. Withholding and Estimated tax.

- Source: Federal Form 505: https://www.irs.gov/pub/irs-pdf/p505.pdf

Oregon

Estimated tax payments aren’t a substitute for withholding.

- Source is OR-ESTIMATE at: https://www.oregon.gov/DOR/forms/FormsPubs/publication-or-estimate_101-026_2018.pdf

- But, according to the auditor I talked with it's fine as long as the estimated payment is on time and the correct amount.

Implementation

Allowances

The way you tell your employer to not withhold income taxes for you is through your W4 form.

* Since writing 99 allowances would probably raise red flags, I'm opting for just enough so that my withholding is $0. It turns out the answer for 2018 is simple. (Gross wages - 3700) / 4150. But here's a spreadsheet to help with that: https://docs.google.com/spreadsheets/d/1EZtnL0C-SE4XJi9uZSjrt1-CW3u8YiJktHPyD1HXhDg/edit?usp=sharing Changed in 2019+. Need to update

How Much?

You need to figure out how much to pay each quarter. While one could use the IRS Withholding Calculator or the above spreadsheet for figuring their current year taxes and pay at least 90% (Federal and Oregon) of it in quarterly installments, a shortcut is just to pay quarterly installments of 90% or 100% (Federal, see below) or 100% (Oregon) of your previous year tax liability. Since it involves less thinking, I'm fine with the latter.

- Can ignore current year realized capital gains because they're for the current year.

To summarize:

Federal

90% (Form 2210 https://www.irs.gov/pub/irs-pdf/f2210.pdf) or 100% (Pub 505 https://www.irs.gov/publications/p505#en_US_2018_publink1000194564) of previous year taxes, in 25% installments every “quarter”.

- Or if your AGI is > $150K, make it 110%.

- Not sure why there are different percentages. So I just make it 100% and everyone's happy.

Oregon

100% of previous year taxes, in 25% installments every “quarter”.

- Unfortunately there's a confusing section near the end in the Oregon OR-ESTIMATE form:

Interest on underpayment of estimated tax: You will have an underpayment if you pay less than: • 90 percent of the tax to be shown on your 2018 income tax return (at least one‑fourth on each payment due date); or • 100 percent of the tax shown on your 2017 income tax return (at least one‑fourth on each payment due date); or • 90 percent of the tax figured on your 2018 annualized income

- According to this section, they consider it an underpayment if you have underpaid in any of the 3 categories! But thankfully further up in the form they clearly say

Enter the smaller of line 13a <90% estimated 2018 tax> or 13b <100% 2017 tax liability>. This is your required annual payment to avoid interest on underpayment of estimated tax.

- Another reference is page 117 of OR-17, where it says the same thing. Have an email from Christian Kelly saying to use this document and they'll fix OR-ESTIMATE separately.

- Also, keep in mind that if you have significant tax events during the year (say large dividends, capital gains taxes, selling house), you should pre-pay the estimated tax for that as well.

When?

If you don't have a lot of taxes to pay, you can combine 2 quarters of tax payments into a 3-month credit card window as done in the cash flow spreadsheet. Pretty clever!

Otherwise just be sure that the payment goes through in time (I saw 2 weeks ahead of time for some Federal processors).

Some more details here: https://20somethingfinance.com/how-to-pay-taxes-with-a-credit-card/

Traditional or Roth? (Taxes now or when retired?)

Should I do Traditional or Roth 401k/IRA? Since when you want to pull the money out of the account when you're retired and <not> working, most likely your tax bracket will be much lower! Traditional it is!

HSA

Pay with credit card now and then keep HSA money invested and growing! Very un-intuitive conclusion that I needed to make a spreadsheet for. I still don't believe it! ![]()

Returns vs. Risks

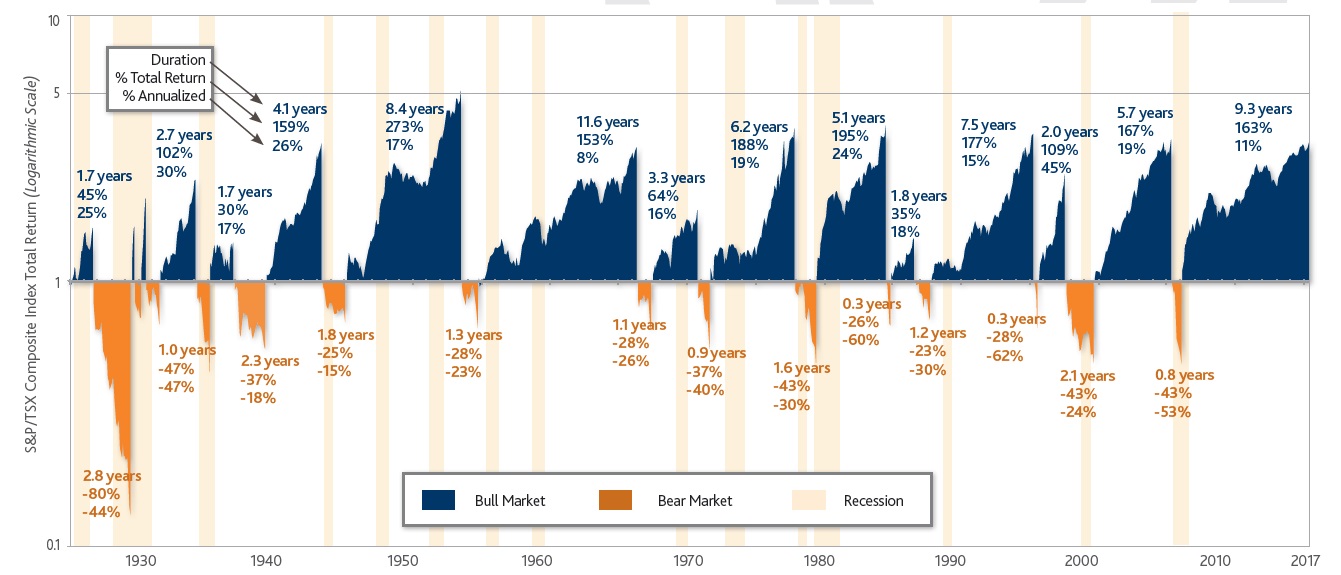

Interesting:

And you can time the market to some extent too! (although not totally sure on this) https://earlyretirementnow.com/2018/02/21/market-timing-and-risk-management-part-1-macroeconomics/

Feel free to ask me to clarify anything and give feedback! nolan.hergert@gmail.com