Table of Contents

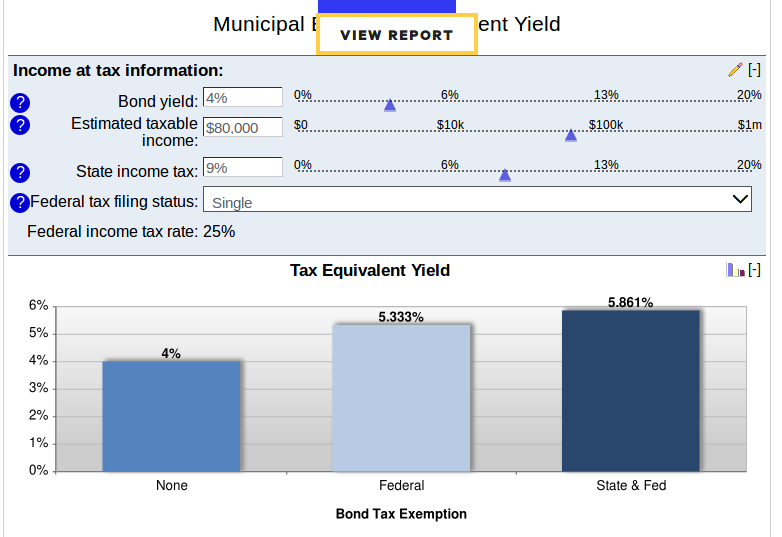

MUNCIPAL BONDS ARE OF NO USE TO YOU IN YOUR 401K!!! MIGHT AS WELL GO CORPORATE

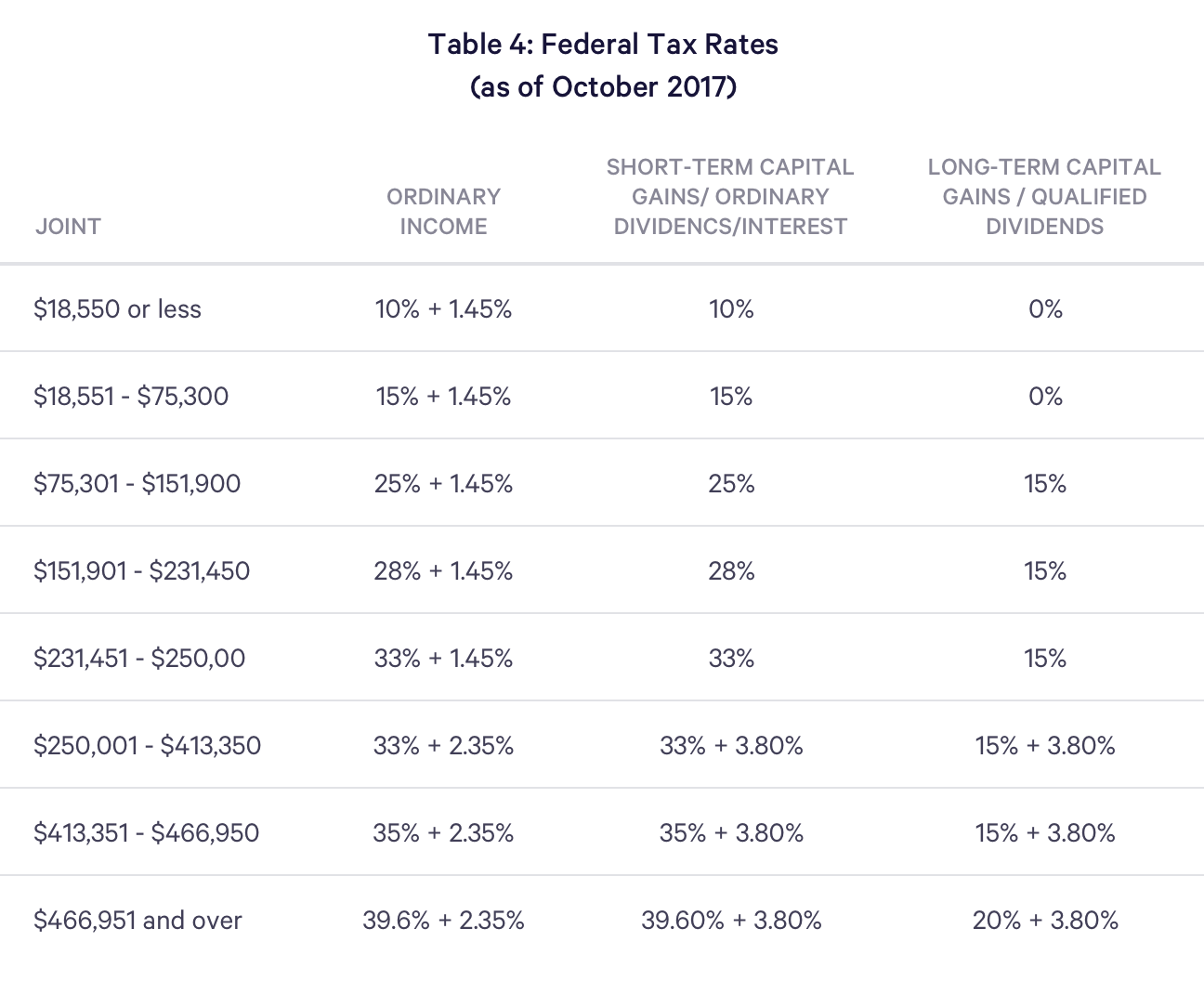

Tax Rates

Wow, excellent example. Up to $75K is TAX-FREE from investment income.

Note: Data is for joint taxpayers.

403b

Mom's thing through the Hillsboro School District. Kind of like a 401k except no employer contribution. And is it separate from PERS? Yes

Grandpa had good experience with Vanguard on the phone

- They take the time to explain things again. No problems.

- Once or twice the person on the phone had a harder to understand accent.

- However, multiple reviews online are saying it's ok for simple stuff but not for more complicated things. Hmmm…

Fidelity looks to be $25 a year with reasonable fund expense ratios too. https://www.403bcompare.com/products/68#/investmentoptions

- 7-day-a-week support

Vanguard is $5 a month. https://www.403bcompare.com/products/164#/investmentoptions.

- Only weekday support

All HSD providers: https://www.ncompliance.com/guest_employervendors.aspx?EmployerID=23

- Vendor comparison PDF: https://www.ncompliance.com/downloads/VendorComparisonID23.pdf

Pomona Plan

Annuity plan. Give them . If you die, they get the principal.

Dividends that they pay you are tax free. Amount in excess of that is taxable.

RIPC to Roth IRA Conversion

Doing a manual conversion June 23 of 8K. Should be no tax consequences.

Need to write down Roth IRA number in memo field on check when you get it.

Unsure about how the contributions will get tracked. Might need to do that manually, or just keep updating the spreadsheet with details.

0% APR Credit Cards and Floating Your Tax Payment

Noodled around on this one back and forth. Most cards have a promotional APR of 0% for 15 months. It's what Warren Buffett / insurance companies do!

| Scenario | Outcome | Dealbreaker? |

|---|---|---|

| Normal month | Pay 1% of balance, auto-transfer | I feel like no |

| $10K in 0% debt, normal scenario | Make average of 8% on it, so $800 in taxable income a year | Too little money for my sanity |

| $50K in 0% debt, normal scenario | Make average of 8% on it, so $4000 in taxable income a year Monthly min payment of $500 | Now we're talking So easily I am swayed… Yet the amount of work/headache is X 5. Hmm… |

| Lose job with $10K of debt coming due in next 3 months | Sell stocks to cover balance after unemployment | Not so bad with savings |

Solo 401k

Useful when self-employed. Allows you to give the full amount (~$50k or whatever) to 401k. However, there's still a “traditional” / elective deferral / “don't pay taxes” limit of the typical 19K. So there's no benefit to trying to do this method as a contractor because Intel now supports the mega backdoor roth. (the same benefit as above)

Marriage

Split Income

Spousal loans are great for income-splitting and tax reduction in a household where you and your mate earn widely differing amounts. By making the less-taxed person the investor, more of the gains can be kept, so loaning that partner money makes sense. The loan rate has to be at least 2% (the current CRA level) with interest paid annually, added to the taxable income of the lending spouse. The costs are deductible, however, in the hands of the borrower. There will be no attribution of investment gains back to the lender – which is the whole point of this exercise.

So if there’s an income disparity in your house, Curtis, you should stop co-mingling your net incomes, pay all of the household expenses yourself then loan her a pile of cash for a non-reg account. And, of course, be a model husband. That may involve flowers and manners. Be prepared.

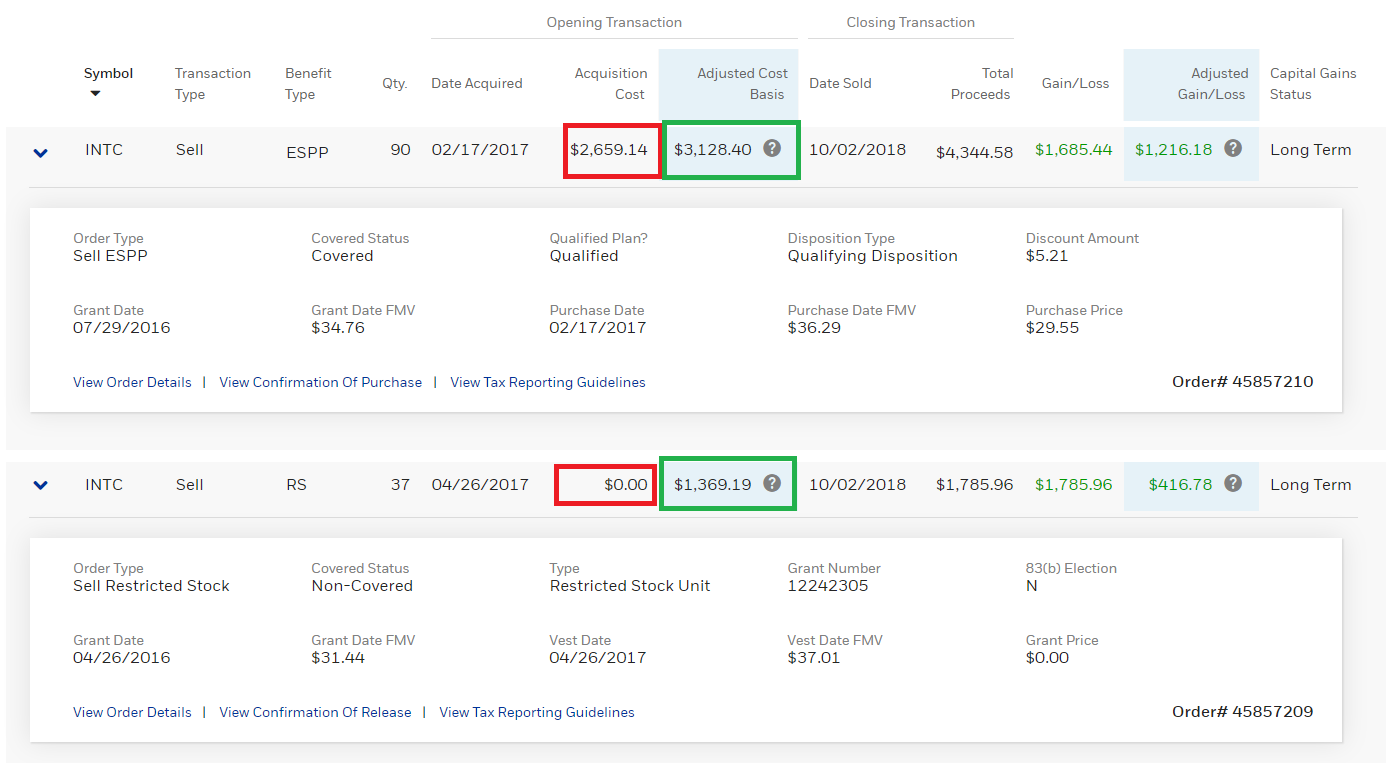

ESPP & RSU Taxes

It's uhh…complicated. Basic reason to care is that for some strange reason, the “income” for these benefits that you receive from your company is counted in your W2 as income, but is not reported as an adjusted basis in your official 1099-B documents. So you're double-taxed on that money, first on the W2 income and then on that income as short/long-term capital gains unless you do something about it!

- Interestingly, it seems it's federal law to do it this way

“Looks like since 2014, brokers are prohibited by IRS (T.D. 9616) from adding the compensation component to the employee cost” https://www.thetaxadviser.com/issues/2016/apr/change-in-cost-basis-reporting-can-result-in-double-counting-of-income.html

“Looks like since 2014, brokers are prohibited by IRS (T.D. 9616) from adding the compensation component to the employee cost” https://www.thetaxadviser.com/issues/2016/apr/change-in-cost-basis-reporting-can-result-in-double-counting-of-income.html

It's weird, because on e-trade it knows about the adjusted basis! But for some reason, they don't report it that way on 1099-B!

-

- Has specific transaction details / prices underneath “View Confirmation of Release”

- However, it's also printed out the same way on the Stock Plan Transactions Supplement. Doesn't include the exact details on how taxes were taken out like the above link, but maybe it's good enough for tax season? Mr. Domes thinks so

The complicated rules for ESPP and RSU taxation are summarized by Intel on internal un-printable pages here:

RSU

- Intel grants say 65 shares, sells ~1/3 of them for you to cover income taxes on the 65 shares, then gifts the rest to you. The whole amount (65 shares) is counted as W2 income when they vest, but when you sell you need to adjust your basis as they're put as 0 on the 1099B instead of ~37*vest price.

ESPP

- Disqualified: ESPP sold before 2 years get taxed as income based on the diff between Purchase Date Value and Purchase Price

- Qualified: ESPP sold after 2 years get the lower of 15% of grant date value or the difference between the sales price and the purchase price taxed as income in that year. Weird.

There are more complicated cases where the stock price is below the sale price, changing the tax. But if you do Quicksale you avoid all that!

Foreign Income Tax Credit

Don't double pay income tax on foreign investments! (I don't have a lot though).

Small business

- 2018 Tax Cuts and Jobs Act made hobby expenses non-deductible. That changes a lot…spend away!

Are you a Hobby or business? It makes a difference. A hobby is by far the easiest way to report income. But no expenses are allowed while SE tax is avoided.

Beneficiaries and stuff

| Will | Trust | Transfer on Death Plan | Donor-Advised Fund | Charitable Remainder Trust |

|---|---|---|---|---|

| Assets have to go through probate (court). $$ and time | All contents have to be withdrawn within 5 years? Expensive to draw up since you have to re-title house and maybe other stuff | Good | Matt Cutts (Google) talks about it. Better than a foundation, apparently. https://www.mattcutts.com/blog/make-money-investing-tips/, and links to “excellent advice”: http://www.businessinsider.com/finally-some-excellent-investment-advice-2011-12. \\Deductible going in, untaxed going out. https://www.kitces.com/blog/rules-strategies-and-tactics-when-using-donor-advised-funds-for-charitable-giving/ Also Intel / Benevity will match as long as you provide receipt. https://soco.intel.com/message/5382165#5382165 Has anyone here opened a donor-advised fund (DAF)? I just learned about DAFs, but they seem like a no-brainer for anyone who does any regular charitable giving. My main interest would be in the ability to transfer in highly appreciated assets (such as old Intel stock with cost basis in the teens), liquidate them tax-free (!), make donations in cash (since many smaller non-profits can't receive stock donations), and take a deduction for the full current asset value. | Untaxed. Pays you out of the trust >5%, gives remainder on death to charity. Seems kinda a way to get out of high windfall taxes and spread out income but stick a charity label on it as you can deplete it before death. Weird https://sivers.org/trust |

TOD Plan

- Allows the money to be disbursed over the lifetime of the person, instead of 5 years (larger taxes)

- Fewer lawyers involved, no probate.

- But should probably check it out with a lawyer too

- Do you need a will? Is it who gets the money from your stuff, or rather your stuff itself?

- The TOD beneficiaries trump Will beneficiaries.

- Make sure the beneficiaries know who they are and print out all logins and important documents in an easily findable folder in the safe.

- Vanguard advice for non-IRA and IRA accounts.

Writing a will

- Easy to copy a basic one online and have it notarized. Once you sign it, you're done!

- Simplifies a lot of things especially if you forgot to put a beneficiary on your 401k.

- Intel will pay for legal services for this too.

Trust and stuff

Living Trust lets you avoid probate fees. Need a piece of paper, with community property agreement.

On death, giftees get the stepped up tax basis.

Can gift up to 11.4 Million for free as part of estate (community property with right of survivorship, different for joint tenants). But capital gains still count.

Also, good to review stuff with a professional. Like the guy on money matters call.

msd@drobnylaw.com. Mark Drobny

Charitable Remainder Trust

- Allow you to lock in high capital gains in focused things with no taxes ever. The principal is given to charities at the end

- You can take out the dividends and etc, but can't touch the principal

- Can deduct the present value of the asset to a minimum of 10% or something like this.

- Something about irrevokable. You can change the charities and …. the beneficiaries?

Charitable Remainder Unit Trust, Charitable Remainder Annuity Trust

1031 exchange

- Allows you to transfer the basis from one to another

- Can only be done with real estate, and investment real estate. (not primary resident)

- Don't file a tax return while under 1031. Do extension or pay late fee, etc.

Business Structures

| Sole Proprietorship | LLC | S-Corp | C-Corp | |

|---|---|---|---|---|

| Liability Avoidance | None | Yes (https://passiveincomemd.com/put-rental-properties-llc/) | Yes? | |

| Effort/cost to prepare | Very little | |||

| Tax Advantages | Pass-through income Business expenses are deductible from personal income | Same as S.P. except you can choose to be taxed as Corp |

- Mad FIentist articles on doing business and avoiding taxes with it: https://www.madfientist.com/start-a-business/. https://www.madfientist.com/section-199a/

MMM switched from LLC to S-Corp, works at scales > $50K profit. http://www.mrmoneymustache.com/2016/02/10/should-you-do-your-own-taxes/

Other MMM forum folks said stay with sole proprietorship unless you need liability avoidance. If you're just consulting, can probably do sole proprietorship.

Other good advice: https://forum.mrmoneymustache.com/taxes/llc-s-corp-or-sole-proprietorship/msg742622/#msg742622

As a way to shield your investments from taxes? Probably not as much? IDK

Messing with Tax Payment Timing

Side Note:

- You can also pay tax via withholdings at the end of the year and keep your money invested all year. It's considered equally spread out throughout the year, apparently! See https://wealthyaccountant.com/2017/03/22/stop-paying-your-quarterly-estimated-taxes/

- Withholdings spread out all year: https://www.irs.gov/instructions/i2210#idm140349202906368

When figuring your payment dates and the amounts to enter on line 19 of each column, apply the following rules.

For withheld federal income tax and excess social security or tier 1 railroad retirement tax (RRTA), you are considered to have paid one-fourth of these amounts on each payment due date unless you can show otherwise.

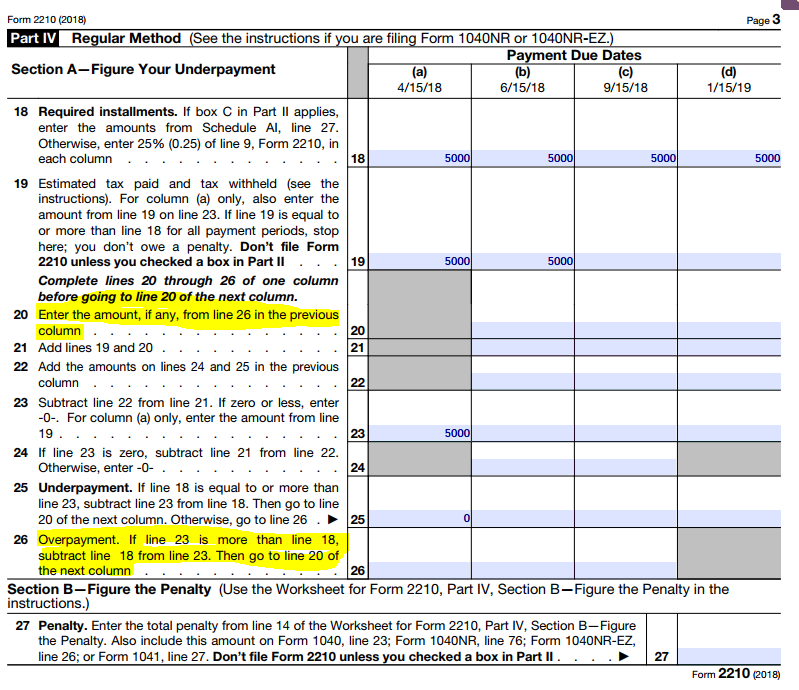

- Thankfully overpayment of earlier quarters carries forward to next quarters. From form 2210:

- Also, if you don't have a large tax bill every 2 quarters and need a large amount of spending, you can make an extra payment for the 4th quarter of the previous year for whatever amount you want. File your taxes right away and ask for a direct deposit refund. Then you pay off the cards a few days later when you get your refund. Interesting. https://wealthyaccountant.com/2017/05/05/the-ultimate-credit-card-rewards-hack/

- Personally I will probably continue with quarterly payments if I need to get credit card bonuses at that time.

One more thing, you need records of this transaction. Pay1040.com makes it really annoying to get receipts after the fact (must enter credit card number), but thankfully the IRS keeps payment history.

Almost -Quarterly Taxes with Credit Card

- It's not every quarter!“ Spring is 2 months and winter is 4 months. Odd

“Cool spreadsheet man”

2% max fee. Can spread it out among vendors! https://frequentmiler.boardingarea.com/2018/02/19/pay-taxes-via-credit-card-2018-edition/

Debit Cards

Also an option. Flat ~$2.50 fee, and some cards give you 1% or more back.

Buying debit gift cards probably not so much, since the limit is $500 and they have a $5 fee to open, etc. Unless you can buy them for 5% off at a grocery store. Not willing to do the work :)

Allowances

Should figure out the minimum number of allowances so that no money is withheld so that W4 is accurate and one-time. “about 20” isn't good enough.

Form 2210

Domes recommended reading it.

- When do I include capital gains tax estimation again??

- I don't think any of the boxes apply to me. Box D is kinda applicable, but I don't think I need to check it.

- As long as each payment is 25% or above 90% of 2017 tax liability, I'm golden.

Form W4

I have tax liability, so I can't be exempt. Now, can I claim 20 allowances to get no taxes withheld and pay quarterly instead?

- Maybe just try it and pay estimated tax bill wayy early so that less red flags go off?

- Zacks says “this is just a general rule to help you make sure you don't over or under pay taxes at the end”

Also, there's no requirement for employers to send in W4 with over 10 allowances anymore. The IRS will figure it out on their end and send a notice if needed to employer.

Federal

Cool with it

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. There are two ways to pay as you go. Withholding and Estimated tax. If you don’t pay your tax tax that way, you might have to pay estimated tax. People who are in business for themselves generally will have to pay their tax this way. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax.

In general, you may owe a penalty for 2017 if the total of your withholding and timely estimated tax payments didn’t equal at least the smaller of: 1. 90% of your 2017 tax, or 2. 100% of your 2016 tax. (Your 2016 tax return must cover a 12-month period.)

Minimum required each period. You will owe a penalty for any 2017 payment period for which your estimated tax payment plus your withholding for the period and overpayments applied from previous periods was less than the smaller of: 1. 22.5% of your 2017 tax 2. 25% of your 2016 tax. (Your 2016 tax return must cover a 12-month period.)

Oregon

Estimated tax payments aren’t a substitute for withholding.

, from https://www.oregon.gov/DOR/forms/FormsPubs/publication-or-estimate_101-026_2018.pdf

- Call them at (503) 378-4988, press 7 to get a

- Can I pay estimated tax payments quarterly instead of withholding?

- How to get DIY withholdings…do 99 allowances?

- Also, just curious how many people are helped by the phone menu information or actually need to reach someone.

- Tax lady mentioned 316.167 and the w4 instructions. Might want to go through the phone system and give the Business Tax department a call (they deal with the W4).

- They seem to not like more than 10 allowances. https://www.oregon.gov/DOR/forms/FormsPubs/w-4-information_150-211-602.pdf

- Oregon taxes, don't like substituting estimated tax payments for withholding, but maybe there's no law against it? There might be a law against a wrong amount of withholdings. Is it “wrong” though if you know you are going to pay them with estimated tax payments instead?

- Got a call back from an auditor on August 27, 2018, missed his name (number is 503-476-6942), saying that the official wording is that way, but they really only care about the proper amount of money coming in at least quarterly. Look at the OR-ESTIMATE document for more information and to fill out the estimated tax worksheet.

- 2.25% processing fee if using credit / debit card. No fee for bank transfer

~2% processing fee to do it, but outweighed by signup bonuses. Trick is to match the quarterly expense (~$15K tax liability / 4 = $4K) with the size of the bonus.

- Try to get cards that don't have yearly fee. Or try to transfer points? Or just redeem as cash…

- The thing is, it's only worth paying it on a CC if it's with a signup bonus. Otherwise have to accumulate and send money over.

- I think I am comfortable now with not withholding anything. However, just applied for a CC

- Computing estimated taxes: https://www.irs.gov/pub/irs-pdf/f1040es.pdf

- Another helpful document, 505: https://www.irs.gov/pub/irs-pdf/p505.pdf

- Need to pay Oregon tax quarterly too, I think.

- IRS questions, based on https://money.stackexchange.com/questions/7714/how-can-i-make-four-equal-quarterly-tax-payments-when-i-dont-know-what-my-inc:

Can I pre-pay the next quarter? Or do I have to do schedule AI, etc?Don't worry about it! Just pay in March 15 and after April 15 (next quarter). Still counts for paying each month and fits in CC 3 month window. Done.

Via Debit Card

For when you don't have a credit card bonus to use…Can pay Federal for $2.59 on a debit card, and some debit cards (M1 Finance in particular) give you 1% back! Awesome.

Oregon says it's $2.59, but they charge you 1.8% or whatever, so can't do it that way.

Tax Loss Harvesting

Want to avoid wash sale, which is when you buy substantially identical (same base index) funds/stocks within 30 days of a sale in:

- Same account

- IRA accounts, Roth and Traditional!

- But probably not 401k and HSA: https://www.bogleheads.org/forum/viewtopic.php?t=202696

- So, have VTSAX around in Vanguard that you sell for credit card / taxes when needed. Also try to have dividends be sent back to checking account.

So, disable automatic reinvestment for IRA and brokerage when you're going to do this!

Also, you can move away from VTSAX into the corresponding individual mutual funds with no wash sale rule, except for the original VTSAX reinvestment, which you need to turn off. Which you wanted to do anyways eventually.

2018

Not going to do it because I anticipate selling next year before drop and want to limit my capital gains….hmmm

- 15% at LTCG is cheaper than marginal tax rate of 25% or whatever.

Municipal/Federal Bonds

Municipal bonds in your state are federal and state tax free. However, there isn't one for Oregon in an index fund, just Franklin Oregon Tax Free (.67% fee).

- Taxable income is after 401K, etc.

So, basically state discount is a 10% bump on return. That's not nearly enough to make up for the performance difference between VWLUX and FRORX. 15,560 * .9 ~ 14004, worse than FOFZX. Overall though, it is worth it to get muni bonds relative to VBTLX, as federal is 25% discount whereas Treasury bond interest is taxable.

- 10-year performance of all accounts

- VBTLX: 14,476

- VWLUX: 15,560

- Interestingly, this is worse than FOFZX after Oregon taxes. (15,560 * .9 = 14,004)

- FRORX: 14,320

- FOFZX: 14,550 (slightly higher b/c fee is .53% instead of .62%)

- Index (Bloomberg Barclays Municipal 20 year): 16,469

Interestingly, interest rates for NJ and others are *higher* than “less safe” cities like NY and CA. (source, vanguard) Well, sounds like it's time to diversify and find out.

- However, some states are “safer” than others due to the amount of state income relative to <private / federal> revenues. New York and California are the worst, relative to New Jersey and Nevada. https://www.forbes.com/sites/baldwin/2011/03/16/whats-your-states-deadweight-ratio/4/

DIY

Probably don't want to DIY buying your own bonds if you want to sell them as that's some work and it's much easier to sell mutual/index fund.

On the other hand, if you plan on holding them, your time has to beat VWLUX expense ratio of .09%.

529 Plan

Have to pay federal income tax, but don't have to pay Oregon income tax for up to $2330 of it.

Earnings grow tax-free when used for qualified educational expenses.

2020+

$150 tax credit, reached when contributing $600 for my tax bracket. Just doing $1K.

2018

4-year carryforward of excess contributions for Oregon deductions. Ohh, probably doesn't matter if you don't have income in Oregon. Hmm…

$2375 for 2018 tax year Oregon deduction - 1250 - 1000 = $125 left allowed Put some money in a 529 savings account for college expenses, an ESA for private school expenses. You have to invest after-tax money, but the growth isn't taxed (so like a Roth IRA).

- Oregon lets you deduct up to $2330 if you do it with their savings plan. Max contribution yearly to avoid federal gift tax is $14000

- Can transfer to a qualified beneficiary (a family member 1-degree related to you)

- Can use for different U.S. college (not just Oregon)!

- PDF all notes here: or_disclosure.pdf

Morningstar rankings of 529 plans?! http://www.morningstar.com/articles/775806/morningstar-names-best-529-collegesavings-plans-fo.html

| Oregon College Savings Plan (TIAA) | Vanguard (AZ, CO, etc) | Author JohnWDefeo (NY) | Conclusion | |

|---|---|---|---|---|

| Fees | .22% | .12% - .17% | .16% | Because of the state tax deduction, worth it to stay with Oregon for the near future Maybe look into transferring later |

| Funds | They have a US market index! | Vanguard funds | Vanguard Funds |

Oregon College Savings Plan Website

Fees: https://oregoncollegesavings.com/research/fees.shtml

Funds: https://oregoncollegesavings.com/research/

Need to use “rebalance” to change investments.

Traditional vs. Roth IRA vs. Taxable

Might want to do 72(t) instead. Just a lot more flexible and don't have to worry about 5-year rules. Can drop a payment? Might want to read more.

Downside of Roth is that you can only take out contributions before 59. Also can't harvest capital losses, but you can only harvest $3k of capital losses per year.

- Also, do I want to deal with wash sale rule? Kind of ok with M1. When the market takes a bad day, just increase VTI share and turn off auto-invest (so dividends don't sneak up on you) and do forced rebalance. Then after 30 days, rebalance back to normal and turn things back on again.

- Also need to make sure Roth IRA auto-invest isn't automatically on either.

- I feel like with ~$100K in taxable, I shouldn't have many issues getting $3k a year for a while in a tumultuous downturn style market.

- Still like Roth emotionally, and don't really want to do the spreadsheet right now.

Downside of taxable brokerage account is that unless your tax bracket is 0% for dividends (~$40K single, $90K married), you'll pay taxes of 15% every year on them, whereas on Roth you wouldn't.

Since my tax bracket is higher than 0% for dividends, doing the Roth.

Older stuff

Can do a Traditional to Roth IRA conversion “ladder”. You pay taxes on the amount converted (low in a low-income situation) and you have to wait 5 years to touch the converted money, but then you can withdraw the contributions early tax-free.

- From: https://www.kitces.com/blog/understanding-the-two-5-year-rules-for-roth-ira-contributions-and-conversions/ and https://www.madfientist.com/how-to-access-retirement-funds-early/.

- Kitces clarified, does *not* mean you can access Roth IRA earnings penalty free, as you still need to be over 59.5.

Backdoor Roth IRA

Contribute $5500 to a non-deductible traditional IRA, but then you can convert it later. It's only helpful if you're above the income brackets for a roth IRA ($118K for single in 2018). https://www.fidelity.com/retirement-ira/contribution-limits-deadlines

Roth In Plan Conversion

Notes from Inside Blue

After-tax contributions will be stopped at the IRS annual additions limit ($57,000, or $63,500 if age 50+ for 2020) if the sum of your year-to-date pre-tax/Roth contributions, the year-to-date pay-period 401(k) match, and your year-to-date after-tax contributions reach that limit during the plan year. Your pre-tax/Roth 401(k) contributions and the applicable pay-period 401(k) match will continue until you have reached IRS limits for those items ($19,500, or $26,000 if age 50+ for 2020 for your pre-tax/Roth 401(k) contributions).

I just talked to Fidelity today about after-tax conversion. They told me I have 2 choices. One is in-plan conversion from after tax to Roth, the money will still be under my 401K savings plan but just show as Roth, and I will have to choose from core investment options. After my call, Fidelity will automatically convert my after-tax to Roth each time they received my contribution.

Another choice is to roll over my after-tax to another Roth IRA, then I have more investment options. The roll over can't be set to happen automatically, I will have to call each time I received a paycheck with after-tax deductions, but there's no limit on how many times and how much per year I can roll over my after-tax.

I was also told if I do in-plan conversion, I will not be able to withdraw from converted Roth money before 59.5 years old and while I am still working. If I do roll over, I can withdraw from converted Roth money early, but may have penalties and tax consequences.

Nolan,

Your 401k contributions will automatically be stopped when you hit the IRS limit ($19,500 in your case). You will not need to change any elections for this to take place.

What will not stop is the after-tax contribution.

The IRS maximum of all contributions combined (401k + Intel match + after-tax) is $57,000 for 2020.

You will need to figure out how much you will be able to contribute to after-tax without going over that limit.

If you are trying to contribute to pre-tax 401k up to $19,500 max and then start contributing to after-tax, you will need to adjust your after-tax contribution % once you hit the pre-tax max.

Using a hypothetical eligible earnings of $150,000, you would be able to contribute $57,000 - $19,500 - $7,500 = $30,000 in after-tax money.

Hope this helps.

Good question! The exact information needed to determine how much after-tax contributions you can make will not be available until after the plan year ends (primarily due to the 401(k) match true-up), so estimates are required. After-tax contributions will be stopped at the IRS annual additions limit ($56,000, or $62,000 if age 50+ for 2019) if the sum of your year-to-date pre-tax/Roth contributions, the year-to-date pay-period 401(k) match, and your year-to-date after-tax contributions reach that limit during the plan year. Your pre-tax/Roth 401(k) contributions and the applicable pay-period 401(k) match will continue until you have reach IRS limits for those items ($19,000, or $25,000 if age 50+ for 2019 for your pre-tax/Roth 401(k) contributions). If it is determined after the match true-up is calculated that contributions were made in excess of the IRS annual additions limit, there is an annual process to refund the excess amounts. You should also be aware that non-discrimination testing could result in a reduction of permissible after-tax contributions. If this happens, excess amounts will be refunded.

To estimate your potential after-tax contribution maximum, you need to start with the IRS annual additions limit (above) and subtract your anticipated pre-tax/after tax contributions (max $19,000, or $25,000 if age 50+ for 2019), estimated match (maximum 2:1 on pre-tax/Roth contributions up to 5% of eligible pay). What is left is your estimated potential after-tax contribution. Because your regular pay and/or bonus exact amounts are not known in advance, your after-tax deferral election for regular pay and/or bonus requires you to make your best estimate. If you have a financial advisor, consider engaging them to help with your estimate.

Notes from Fidelity RIPC setup

Intel doesn't automatically switch

What is the VAC/PA CASH OUT PRE-TAX thing?

Roth Basic, is the normal Roth 401k money. But Intel doesn't allow withdrawal until 59.5

Roth In-Plan Conversion withdrawal is allowed, however.

- If going to an external account, they will need to liquidate the funds, but they do send a notice of the cost basis along with the check.

How will it switch over from Traditional 401k at 19K to RIPC?

- Fidelity rep says that they could do it, but Intel is doing it themselves and it says Intel won't stop me at the deferral limit.

Set up transfer to external Roth IRA? (M1 finance). Is it difficult, or should I just not bother with it?

- Allows easy automatic purchasing of ETF and stocks in fractional amounts. Fidelity would limit to just mutual funds

Others

It's the 401k “mega backdoor” roth.

For example, say you’re under 50, earn $100,000, and you’re contributing $19,000 to your 401(k) plan this year. Let’s say your employer matches your contributions 100%, up to 3% of your salary. That means it’s putting in $3,000 this year. The maximum amount you can put in the after-tax portion of your plan this year is $56,000 minus $19,000 minus $3,000, which is $34,000.

– https://www.nerdwallet.com/blog/investing/mega-backdoor-roths-work/

Roth IRA ($6K) is separately counted

- Fidelity will provide the option which you can exercise after your first 2020 Roth after tax contribution (intended for RIPC) — you can call them and say “convert this to Roth IRA *now* and do this for all future RIPC contributions) on January 3rd.

- This option guarantees that your basis / tax on conversion is always == to contribution (no tax) and simplifies everything.

- Can also do an in-kind transfer to M1. set this up?

Can't they do this for Traditional 401k too? Convert it to an IRA you can keep anywhere, including M1?

- Yes, but only if you're 59.5 or leaving your current company.

Chart!

More to do here…what is the benefit of an IRA if you're just going to pay taxes on principal and interest later?

| 401K | IRA | Roth IRA | Taxable | Cash Balance Acct. | |

|---|---|---|---|---|---|

| Features | Tax-deferred Employer often matches | Tax-deferred If employer non-matching, deductible? | Pay taxes on principal only | Can tax-loss/gain harvest Ordinary dividends (held 90 days) and long-term gains are tax-free up to a joint income of 75K (as of 2017) | Can put a bunch of money into it |

| Max Yearly Contribution | $18,000 ~$60K with after-tax | $5,500 total | Lots (>$100K per year) But has to be the same every year, despite downturns |

||

| Early Withdrawal (particularly required minimum) | Can rollover to IRA when leaving company. So look at IRA rules. | 10% penalty on early withdrawal of principal and interest, on top of ordinary income tax. Have to do RMD | Can withdraw principal at any time with no penalty. No RMD's, cool! | Can take out at any time. | Not sure |

| Retirement Withdrawal | Everything taxed as ordinary income | No taxes on everything | Not sure | ||

| On death | Unless your spouse is alive, you can't directly gift an IRA. However, it looks like you can do a trustee-to-trustee transfer that you maintain for the deceased and you can pull from it. https://www.irs.gov/publications/p590b#en_US_2016_publink1000230542. Weird! Also, stuff about withdrawing over a lifetime. Ehh, I'll get to it later. | Not sure | |||

| Can loan money from | Yes, up to 50K | No | |||

Go curry cracker on how roth burns your money… ![]() https://gocurrycracker.com/roth-sucks/

https://gocurrycracker.com/roth-sucks/

- Yes, you do pay dividends on normal account if you make lots of money. However, it's 15% tax bracket, vs. the ability to do tax-loss harvesting.

If you have 401K at work NOLAN DOES!, and you make more than $71K net! (after taxes, screwed that one up), you can't deduct taxes on traditional IRA. However, you can fund a Roth IRA still. IRS source.

Interestingly, you can contribute “post-tax” to a 401K in excess of the 18K limit, up to a $50K+ limit. However, your employers plan must support it, which mine doesn't.

Roth vs. Traditional

Bogleheads wiki page is great for this.

If your retirement tax bracket will be lower than when working, then traditional will probably win, especially if you are not maxing out your IRA/401K. If you are maxing out your IRA/401k, then you need to take into account the leftover money that now needs to go into a taxable account to grow, where each transaction/dividend is taxed according to some rules. (basically, contradictory to below, it's not 0% taxes for leftover money).

- Don't know the right answer yet, but the excel spreadsheet on the bogleheads wiki seems good

Older stuff on this topic

- Better to do traditional vs Roth:

- Run the numbers here:

https://research.scottrade.com/KnowledgeCenter/Public/Calculators/RothVsTraditionalIRA?$5K roth is actually $6.5K in real income. It doesn't assume you will invest that $1.5K difference between the two!

- Formula with annual contribution:

Balance(Y) = P(1 + r)Y + c[ ((1 + r)Y - 1) / r ], moneychimp

- If tax rate is same in retirement, then it's the same.

- However, assuming current taxing brackets and amounts won't change, you will be living off of the dividends from your nest egg, making you a “low income” person paying few taxes.

- And as it turns out, the government lets you take a lot ($80,000??, read it somewhere) of qualified dividends (all dividends from US companies are qualified as long as you've held them for a while) and long-term capital gains at a much lower rate than income.

- Re-read comments. Depends if you plan to retire early or keep working and have a forced large retirement income (as G&G do). Run the numbers a little. Then worry about other stuff

Taxes (blegh)

Service

Online Taxestheir software doesn't show everything on one page, makes you do lots of clicking “next”.- Also says “unfinished” for OR and CA when you change something, but they don't show you what needs updating! Makes you click a bunch for seemingly no reason. Just recompute and get it done!

-

- 61.83 out of total (71.75) is qualified dividends (no taxes). The form figures it out quite well, as well as Credit Karma Tax.

- For Oregon, be sure to include Oregon tax kick back.

- Aren't dividends from treasury bonds in VBTLX state-tax-free? https://www.bogleheads.org/wiki/Tax-efficient_fund_placement#Tax_efficiency_of_bonds

- State tax free, yes. But not federal. Hopefully you can do this.

Withholding

Benefits

- Get more money throughout the year

- Pay with credit card and get sign up bonus tax time.

Disadvantages:

- Computing wrong (more than $1000 owed at tax time) gets you audited probably.

Each allowance is worth $4150 (2018 annual basis allowance) / 26 (pay periods per year) = $160 not calculated for withholdings from your gross income. That amount is subject to the marginal federal income tax rates.

- Unfortunately I have 4 different answers on my tax obligations! Silly calculators.

Rolled my own and it lines up good with IRS calculator. https://docs.google.com/spreadsheets/d/1EZtnL0C-SE4XJi9uZSjrt1-CW3u8YiJktHPyD1HXhDg/edit?ouid=112588767989536456583&usp=sheets_home&ths=true

Here's a great calculator for this https://turbotax.intuit.com/tax-tools/calculators/w4/, separate from the IRS calculator. https://www.irs.gov/individuals/irs-withholding-calculator. Turbotax says 6 is bringing me about $500 underneath, we should be good from there…hopefully.

Make a calendar reminder to recompute in the summer after you contributed to 401k.

2020

Estimated Payments

Payment + Fee = Minimum Spend –> Spend/1.02 = Payment (includes fee)

Should deduct expected W2 tax withholdings too…. Was over Federal 2019 return by $5K and Oregon by $4k.

| Federal | Oregon | |

|---|---|---|

| Total 2019 | $15000 | |

| Quarterly | $3750 | |

| Apr 15 Need to pay $2678 w/ cash, rest w/ CC's | $250 w/ Delta Amex on Pay1040 Due July 15 here | 62 paid already using alliant CC $171 with work bonus debit 979 on PNC CC, 699 on BBVA CC Oregon is not extended |

| Jun/Jul 15 | Extended to July 15 Paid $142.50 from Wirecard June 18 on PayUSATax website $2000 off of Sofi Debit on Pay1040 on June 22 $2997.42 via Pay1040 and Discover Card 2850 via PayUSATax and Discover on July 2 | Paid $2000 via checking on June 9 |

| Sep 15 | $1300 paid 8/25 | |

| Jan 15 |

Better figured and documented on the spreadsheet: https://docs.google.com/spreadsheets/d/1jIZkq4E1rHqPdO0nj6-WUV8bFsqBsg9qdbwU2ENpHQs/edit#gid=2117520066

Pay on PNC (2% fee). Rather get a new card, do auto-transfer of minimum payments and get 0% APR?

$10K credit limit, 0% until July 2021

Donations

$50 Feb 4 for West Valley trip $785 Mar 28 for Kickstart.

TLH

Sold $18K of VOO ($3K of short term losses) for VTI on April 6. Will increase VTI allocation to ensure incoming money doesn't go into VOO.

Turned off auto invest for Roth IRA and taxable account, just in case. Only need to worry about wash sale for VOO.

Did a number of stock sales on Robinhood in June in anticipation of buying car and finishing LTCG.

2019

It's helpful for Mr. Domes to review the numbers with all the forms and individually indicated on the Schedule … D?

Get W2 box 1 and box 5 breakdown from Workday. Workday → Pay → My W2 Breakdown. Also helpful is printing out the last payslip to make sure Oregon withholdings are correct (Oregon WBF and Transit Tax).

Make sure that the 1099's from the banks match what you expected for signup bonus income.

1099's

Bonuses:

| Expected | Received |

|---|---|

| Chase checking/savings and brokerage | X, brokerage X |

| SoFi Invest (probably under apex) | |

| ETrade | X |

| Ally Bank Trading | X |

| PNC | |

| HSBC (200) | X |

| US Bank (250) | X |

| Wells Fargo ($400) | X |

| Capital One Savings | X |

| Discover Savings ( | X |

What about small interest? ![]() →

→ ![]() (less than $10 interest is not reported to IRS!)

(less than $10 interest is not reported to IRS!)

| Bank of the West | |

| Homestreet Bank | |

| Columbia Bank | |

| KeyBank | |

| Citi | |

| Charles Schwab | |

| NW Priority? | |

| Alliant | N/A |

| First Tech | N/A |

Normal:

| Expected | Received |

|---|---|

| Vanguard | X |

| M1 Finance | X |

| Robinhood | X |

| ETrade | X |

Donations

Look under “benevity” under email for receipts.

$200 to Liberty Robotics, matched $200 by Intel.

$750 to Liberty Robotics for payments for Houston robotics trip. I will attempt to volunteer the whole time.

$200 to Elevate Oregon for Chromebook. +300 for general donation.

$300 for Liberty Robotics Santa Clara trip. Volunteering the whole time.

$1276 for Kickstart International. Paid on CC

Estimated Payments

Payment + Fee = Minimum Spend –> Spend/1.02 = Payment (includes fee)

| Federal | Oregon | |

|---|---|---|

| Total 2018 | $15000 | |

| Quarterly | $3750 | $1750 |

| Mar. 27 | Done (Pay1040) | Done |

| Jun 15 | Done (Pay1040) 1.87% | Done June 7 |

| Sep 15 | 696 out of $3750 Jul 8. Paid 4418 on Aug. 6 for travel expenses | Done Jul 8. 1792 total. |

| Jan 15 | $1354 / $3750 already paid $1261 on Wells Fargo Need to add $1446 (LTCG) + $300 (income) for signup bonuses $2881 required. $2881 paid + $53 fee on Alliant CC | $1750 + $954 (LTCG) + $75 (income) Paid $879 on Fidelity. $1900 even remaining Paid with checking transfer |

Nov 2019 Capital Gain and Interest Calculation

Not necessarily the best idea to pay $2K in taxes to gain $1K in brokerage opening fees, but I do get some capital losses on the way back down…

Vanguard:

- $858 in LTCG in May/August 2019. Pay with $128 in witholdings (to spread out evenly throughout year)

- $7329.2 in LTCG in Nov 2019. $1099.38, pay via estimated taxes.

M1 Finance:

- $2314.27 in LTCG in Nov 2019. $347.15

- $55.24 in net STCG, at 40% marginal tax = $22.10

$9643 in Nov 2019 LTCG. For Fed at 15% it's $1446, for OR it's 9.9% income tax so: $954. Both are DONE!

Checking account signup bonuses:

- Q3 Wells Fargo: $400

- Q3 US Bank: $300

- Q3 HSBC: $200

- Q4 Chase: $600

- Q4 Discover: $150

Pay Q3 with withholding ($900 * .4 = $360). DONE! Pay Q4 with CC: ($750 * .4 = $300). DONE!

Technically .4 amount includes federal and state income tax and done the same below, but whatevs.

Setting Federal withholdings in december 1 to be 10. Used to be 28, need 12 minimum delta for $500 bi-weekly withholding according to https://turbotax.intuit.com/tax-tips/tax-refund/fatten-your-paycheck-and-still-get-a-tax-refund/L5HaySdDP. So only technically need 16, but going to 10 in case things are off.

- Setting state from 38 to 10 as well. Would rather overdo rather than underdo.

- $285.65 withheld on Dec 15 for Federal. Do once more, that should be good.

2018

Remaining

- Schedule B interest part 1, 0 interest from vanguard, then why is it there?

- Under Oregon schedule OR-A (itemized deductions), where does the $2350 figure come from?

- Unfortunately I think that's the exact amount of the estimated tax payments.

- This shouldn't happen. Sent an email to Credit Karma, but use their Accurate Calculations guarantee thing if needed. https://help.creditkarma.com/hc/en-us/articles/360001488046

- Make sure espp sales are reflected in appropriate 2018 or 2019 dimms. Also that it's not double counted.

Hiccups

Had an issue with entering a 0.09 sale price at a cost of 0.10. They both rounded down to 0, and I needed an entry. So made the 0.10 cost to be 1.00 so the fed would be happy.

Overall changes because of Tax Cuts and Jobs Act: https://www.irs.gov/pub/irs-pdf/p5307.pdf

- Nothing that relevant to me that the calculator wouldn't figure out.

- Don't get IRA recharacterizations, but I don't think I need to either.

Withholding Calculation

79293, 15334 * .9 = 13800 - 8461.62 = $5.35K ouch, should be $3750. Did I underpay federal?? Better calculate 2018 obligation and go for 90% of it. I hope not…

79612, 6929. * 1 = 6929 - 4784 = $2200. Also less than $1750, hmm. Calculate Oregon.

Let's go 1700 federal direct pay (done) and $500 $600 oregon direct pay (done, Sep 10).

- Also on Dec 26 did $1750 for Oregon (see email) and $3750 for Federal (see email)

$1250 to Kickstart. $750*2 for bills, gifts and expenses…$300? = $3K + $5.5K for taxes = $8.5K, which requires 3 paychecks of $3300 each. Leaves buffer of $1.4K, should be fine investing November 1st paycheck in the market dip.

- Missed taxable…?

- Oregon Political Tax Credit, $50, you would get back 100%.

- Bunching if needed. (getting annual medical expenses done twice in one year, and not the next)

- Contributed $1250 so far to 529. Max free for Oregon is $2375 for 2018

Other stuff

- Not sure what this means

If you have stock options be sure to report on your schedule D for capital gains that the 1099 from the brokerage firm which handles the stock options is NOT accurate. Brokerage firms are now NOT allowed to report a cost basis for your stock option which includes a correction for the amount of the option that is reported as income. Even though it is reported on your W-2 that you have income from stock options (look at box 12), the IRS ignores this information and looks only at the uncorrected 1099. Hence unless you make it explicitly clear in your return they will count twice the income you made from the stock option and send you a rather large bill which reflects this error

- Stephen P. at work mentioned something like this, that UBS considered your discount as income or something. Which shouldn't have happened. And supposedly it's fixed with E-trade.

2017

Vanguard supposedly sent me Form 5498. Ahh, IRA contribution document.

Don't forget to discount vbtlx income from state income tax…somehow. It has some treasuries in there.

- Yep. PDF is located here: https://investor.vanguard.com/investing/taxes/government-bonds, for 2016: https://personal.vanguard.com/pdf/USGO_012016.pdf

Did already

- Contributed to Roth IRA the full $5500. Would do traditional, but make too much. Take what you can get…

- Note Go Curry Cracker's article on why he doesn't like the Roth IRA compared to normal investments. Maybe it changes for older retirees?

- Contributed $2330 to 529 for now. In conservative allocation, need to change.

- Kept 401K funds in viix (large stocks) as didn't like diversification of other bond options (lowest expenses was us debt)

2016

Probably going to use free fillable forms (https://www.freefilefillableforms.com/#/fd) for both federal and oregon, but not sure which form I should use yet…

- How do I manage <file taxes for> 401k/IRA over time, for roth and traditional?

- Still not sure yet, but there's money that's withdrawn from your paycheck that doesn't count. “Wages, Tips, etc” from W2 is after tax-deductible is taken out.

- You have barely investment income from non-sheltered accounts. Need to get report from vanguard

- Received several 1099-INT/DIV from various folks. Not over $1.5K, so can total and enter into 1040 directly on line 8A and 9a/b.

- Capital gains requires form 8949 and 1040 Schedule D. You receive a 1099-B that you use to fill them out with.

- One can take classes and get a ~$2500 credit per year if you make less than $65K / $90K (can only use 4 times). American Opportunity Credit /Lifetime Learning Credit. https://www.irs.gov/pub/irs-pdf/i8863.pdf

- Forgot to make an exemption for myself, need to redo 1040 income tax calculation form. Done.

- Medical expenses for Federal are only deductible if they are over 10% of your income. For Oregon it's deductible if you're over 64, limit of up to $1800. >.<

- How much money is that worth? $~180 back at 9% tax bracket

- Got to deduct? federal tax liability, which was after $7500 rebate.

- Form 1099-MISC doesn't count for housing rent, just business rentals. Great!

- Intel taking money out of your paycheck for HSA apparently counts as company funds and not your own.

- Might be worth it to try out Credit Karma next year and see how it goes.

- IRS rejected it, can't deduct $22 in student loan interest because I make more than $80K.

It doesn't look like Credit Karma will catch that gotcha though…

It doesn't look like Credit Karma will catch that gotcha though…

2015 Tax Year

- Did you receive Form 1095-C? (health care coverage from employer?). FInish health care section

- Field 12 and 13 on W2. Need to re-look-at from intel website or something

- Schedule C 2605 for labor, 261.54 for reimbursements for parts.

- Put parts as …. something

- IRA contribution, Form 8606, call Fidelity Investments at 800-427-6148

- Minimum Shared Responsibility…finish that! $777 Market granted exception?

- Taxes tab, health exemption

- Free federal filing: http://apps.irs.gov/app/freeFile/jsp/index.jsp?ck. California has online form, so does Oregon.

- Going with Online-Taxes.com for now as the income level can be up to $60000.

- EXCELLENT! WOULD HIGHLY RECOMMEND! Somehow I got free everything, when PA and CA are both non-free tax returns. All of the suggestions were right too…Awesome.

- NOT FREE ANYMORE?!?!? And ORegon is supposed to be free?!?!

- Cal password is random password but with the '@' sign changed to an 'a'

- Finish form 1098-T too, should show up tomorrow.

- CMU uses the iPay system for W2's, but if you're 90 days late, you need to call them directly at 412-268-2097