Table of Contents

Real Estate Investing

See Leverage in Money first.

Can ignore $250K/$500K of capital gains on house if you lived in it for 2/5 years prior.

Improvement expenses increase the basis, so less capital gains. Need to keep receipts though.

https://www.moneycrashers.com/reduce-avoid-capital-gains-tax-property-investments/

Rick Boyd says

- “make a separate LLC so they can't come after you”.

- Also, Newberg's a great place, nearby a Christian college. Can pick up a place for $150K in a down market, for $1K / month rent you can get it paid off in 1 year.

- 20% down lets you avoid insurance

Real Estate

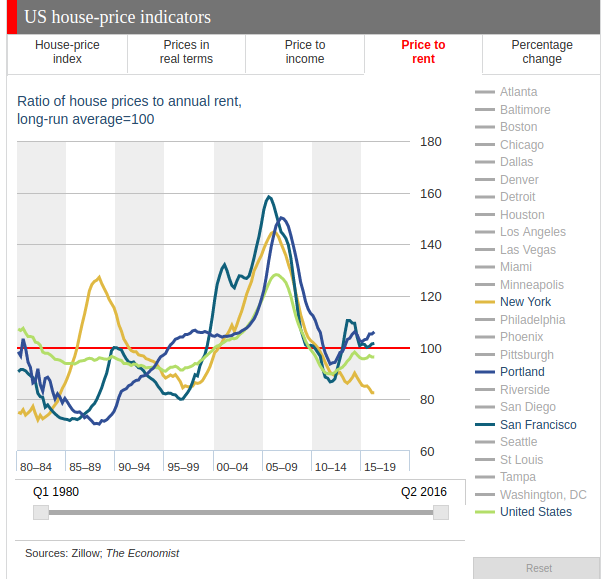

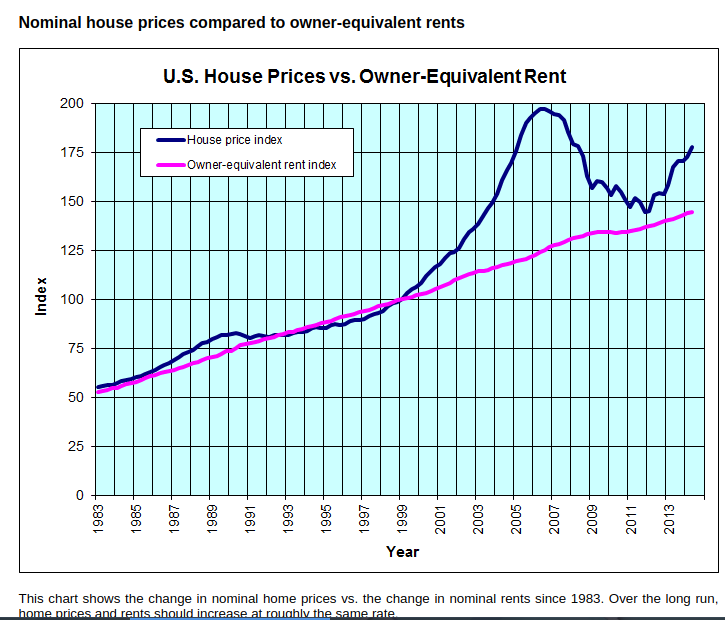

Price to rent ratio

Mr. Money Mustache has a good article on this: https://www.mrmoneymustache.com/2012/03/09/housing-prices-bargain-of-a-lifetime-or-much-further-to-fall/

Several great articles on Early Retirement Now.

Couldn't find a good map on price / rent ratio. However it seems you can download it from Zillow?

Fascinating plot by the economist magazine…https://www.economist.com/blogs/graphicdetail/2016/08/daily-chart-20 and http://www.jparsons.net/housingbubble/

,

,

If you want to put in the liability and work to improve a house and rent it, your best time to buy is in the bottom of a downturn. Housing prices tumble (probably because of “free” money), but then rents don't change.

I would like to understand how home loans are so cheap whereas the money to be made by renting is decent. Why aren't home loans higher interest?