Table of Contents

Signup Bonus Harvesting

I'm signing up for a checking account with you guys, but I don't want to order a pack of checks. How would I do that? –Me

Chase Sapphire Reserve only gives 1% back on purchases (1.25% if redeemed for travel). While it's worth it to spend $4K for the signup bonus of $500 or so (12% return), it's not competitive for amounts beyond that! I'd rather get 2% in cash with a different card, even if it doesn't have a signup bonus!

- So that's why Chase has such high referral payments to bloggers ($100)…because they charge 1.5%-2.5% in processing fees to the merchant and only have to pass along 1.25% to the card holder!

- So all these blog folks that are hawking free first class everything travel…for folks to actually get the other $500 they have to spend ~$40K on their Chase card instead of $25K on a 2% cash back card! I wonder why they don't talk about that…

Fraud

| Card | Cause | Ticket | Resolution |

|---|---|---|---|

| BBVA card Nov 2020 Shortly after doing $1 transactions on Amazon on laptop, needed to enter this full card number Number of temporary transactions reversed + 1 persistent transaction | Windows laptop, wipe it and do linux | In email to self | ? |

| Fidelity card July-ish 2020 Several large transactions |

Personal Expenses on Business Card

T&C's say not to do it, but the worst they can/will do is cancel the card?

Separate credit bureaus, less consumer protection against purchases, higher interest rate. No big deal to me…

However approval is trickier. Requires an actual business? (sole prop?). And EIN (does SSN count?). Can apply for one with IRS?

No just called them and they insisted on business documents! They even tried to validate with the state webiste. I have wasted two hard pulls in the last 8 months with Wells Fargo and US Bank business credir cards!

Applied for BofA card with sole proprietorship and $500 sales / year, but was rejected. https://www.doctorofcredit.com/targeted-bank-of-america-business-cash-rewards-500-signup-bonus/

- Will get a letter. Maybe it says to do a secured card instead?

Money Transfer

When transferring a large amount of money (probably > $10K?), it raises a lot fewer questions when the money is sent from the holding bank to the new bank, as opposed to the new bank requesting the money from a holding bank. Same sort of thing for writing a check.

Re-Bonus Limitations https://thepointsguy.com/guide/credit-card-application-restrictions/

- Wells Fargo is once every 6 months, 15 months per card.

5/24

Running out of cards to apply for, so I probably want to refocus on big ones only.

Choosing to wait for Jan 2022, at which point I should be able to apply for higher <cash> bonus cards. Chase doesn't care when you close the card, so closing existing annual fee cards a little later is ok.

Doesn't limit me from applying for a few cards until then, but needs to be ⇐ 5 over 24 months. So let's make an arbitrary reward of … $400? Should be fine. Not all vendors do 5/24, so I can sign up for them in the meantime. (Wells Fargo, etc).

BarclayCard

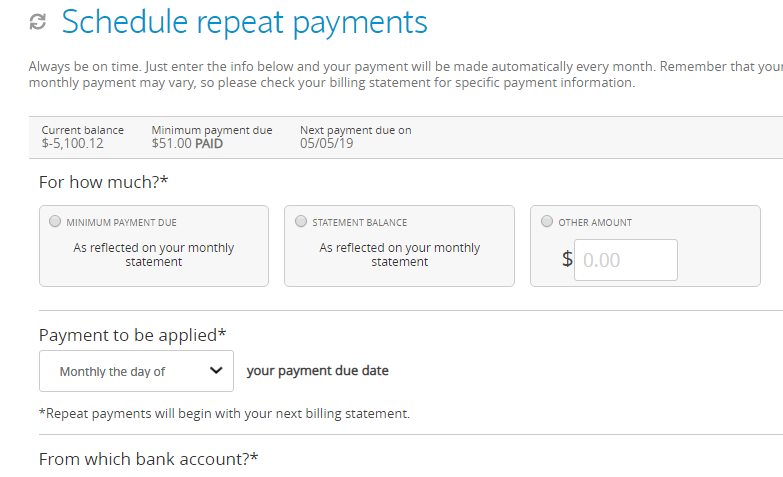

- Lacks being specific or doing another option, current balance. Thankfully on the next screen, it clarifies it will charge the lesser of your statement balance or your current balance. But it really should be statement balance - payments against it, or “whatever is needed to prevent me from getting interest”.

Please note: If your current balance is less than your scheduled repeat payment at the time we process your payment, we'll reduce or cancel your payment accordingly. Also, when your selected amount is less than your minimum due, to ensure your account does not go past due and that you remain in good standing, your repeat payment will be increased to the minimum due amount. If you do not wish to have this amount increased, please contact us by 7 pm on the scheduled date.

Case 2708728.

Brokerage Accounts

Even though the signup bonus looks small, you can keep your money invested! (so still free money, just not very instant). https://www.doctorofcredit.com/best-brokerage-bonuses-earn-up-to-3500/

However, you want to use ACAT transfer to keep your cost basis. Even a 2% bonus isn't worth it if you have to liquidate. https://docs.google.com/spreadsheets/d/1VBytwn-MRGtq0vDNQ4ZrJBKnAHcReGQqRcEqoc7Dq3s/edit?usp=sharing

| Place | Deal | Result | ||

|---|---|---|---|---|

| Chase YouInvest | $25K/$200, invested for 90 days Keep checking account for 100 free trades every year, although probably pulling out money before that But don't fully deplete or else face $75 account closure fee? | Buying VTSAX 11/28/19 ish | ||

| Sofi Invest | $1000/$100 | $100 received Nov 22-ish. Wait for a while? | ||

| Sofi Invest #2 | 1%. MINTAX, will refund $75 of closing external account.\\90 days minimum\\$75 to close the account | Pursuing ACAT transfer soon. | ||

| Etrade | $25K/$200 | Purchasing VTSAX 11/28/19 ish | ||

| Ally Bank Trading | $25K/$200 | $18K transferred Was under $25K by $500 >.< Must have forgotten about it mid-transfer Only $50, reward received already | ||

| Schwab | Nice | N/A for me since I opened brokerage already | ||

| PNC | $25K/$125 or $50K/$250, invested 1 year? Requires calling on phone, which is ok, but too much time and $ now Requires managed acct (2%/year AUM) | |||

| TD Ameritrade | $25K/$100 or $50K/$200, invested 1 year | |||

| Merrill Lynch | Decent bonus, but requires large balance checking account with Bank of America | |||

| Fidelity | $50K / $200 | |||

| Tastytrade | $2000 → $200 in stocks | Need to keep for 90 days. Any account fees? Want to do it | ||

| Interactive Brokers | 1% up to $1K | 1 year | Transferred $112K on 11/9/2020 ish , and basis is here, but basis is not reflected on display correctly. Weird Transfer out extra down to $100K when ready |

Checking Accounts

Checklist

- For ones that require direct deposit, make sure to verify transactions back to your original credit union right away so that it doesn't take 5 days to get your paychecks back!

Some are not that annoying! https://www.nerdwallet.com/blog/banking/best-bank-bonuses-promotions/. Usually maintain balance / account for 90 days.

- US Bank (done). No fees if doing direct deposit. But want to stop at some point…

- Bwhahaaa. $200 external electronic transfer limit for your “safety” and $3 fee per transaction. Nooooo thank you! Hopefully they can get me cash or a bank check today.

- Huntington: $1000 transferred in. $5/month charge unless 5k balance. Keep account open for 90 days.

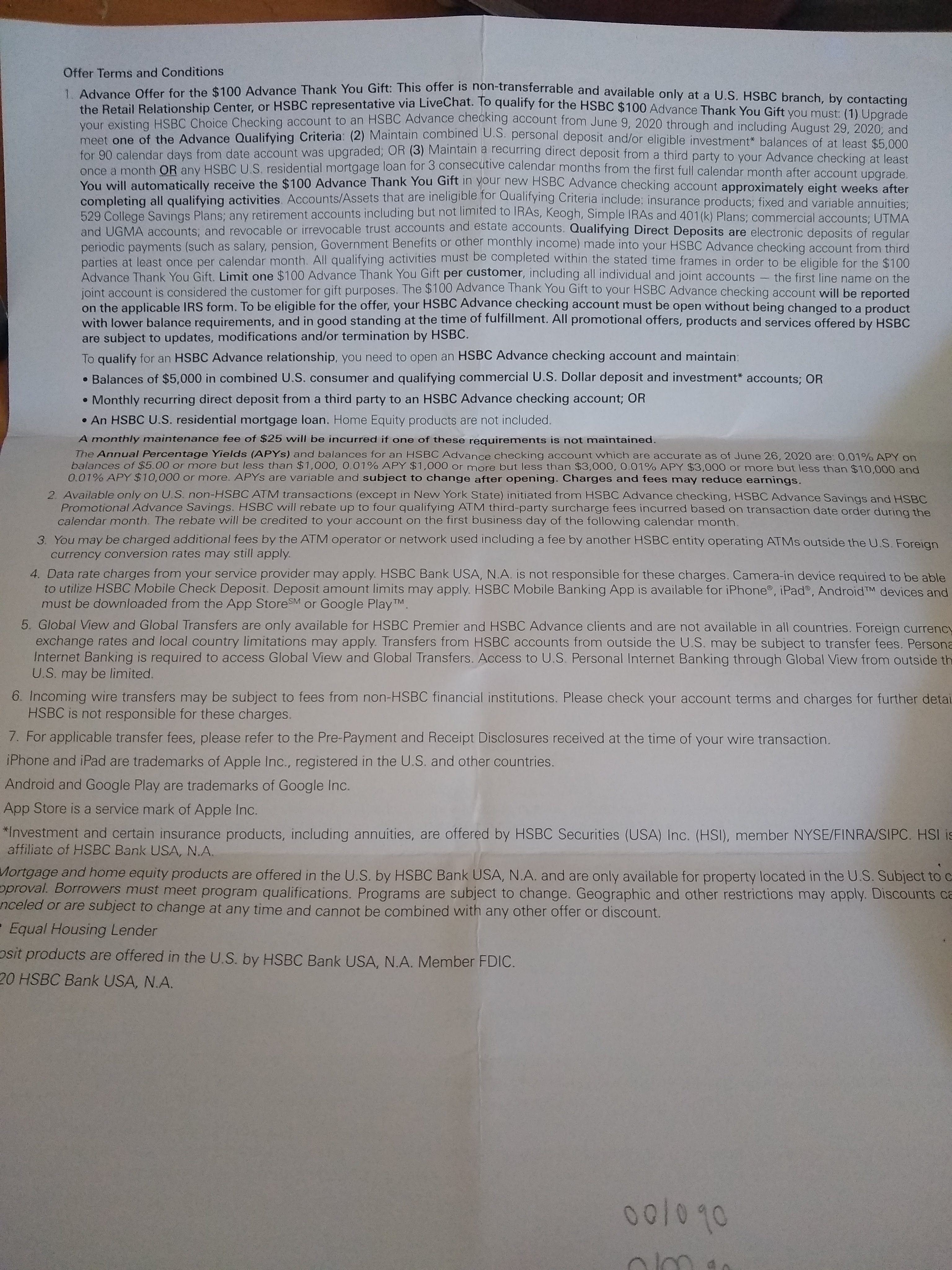

- HSBC Choice Checking ($1500 transferred in (not necessarily direct deposit, maintained for 90 days). By March 31.

- $5 monthly fee for balance < $5K.

- $25 early termination fee if before 180 days. Well, bummer.

- Would I do the work for $150, less tax? Not really…

- Premier Plus Checking. Might add Savings of $15K for additional $300 (8% annualized). https://accounts.chase.com/consumer/banking/online?px=YW47222&jp_aid_a=/Acquisition/ConsumerBank/P2XLOBChamp600&jp_aid_p=chasehome_3/hero#

- Just need one direct deposit. Can close afterwards. (one month)?

- Capital One 360. $25 * 3

- Wells Fargo, direct deposit of $3k each month for 3 months for $400. Don't seem to be electronic transfer fees, also no fees if you have DD's.

- There should be no fee to transfer money out of it.

- KeyBank, big bonus but need to be invited.

Bank of America

Maybe more useful ones here, but already scanned through. https://www.nerdwallet.com/blog/banking/best-bank-bonuses-promotions/

| Bank | Reward | Fine Print | Date |

|---|---|---|---|

| Chase | $300 + 2% of $15K for 90 days of mucking around. 8% risk free return, before interest taxes | $500 direct deposit in checking monthly. $15K in savings for 90 days. Transfer $25 monthly to savings from checking. Don't bail out before 6 months or else you will get billed for bonus. https://www.doctorofcredit.com/chase-600-checking-savings-bonus/  | Accepted Aug 20 2019 Got $300 early, $300 later on Nov 28. Waiting for 6 months Closed May 18 2020 |

| PNC | $300, but no acct minimums | Within 60 days: 10 debit card transactions (use square cash or Amazon balance reload, $1 min for free), $5K of direct deposit Fee avoidance: $5K in direct deposit per month? Or $25 early account closure fee Bi-weekly pay is $3k. Can use Paypal, what is their routing number? | Accepted 8/22/19 $300 deposited a while back. Still maintain $5K/month through Paypal or $25 account closure? Closed May 18 2020 |

| HSBC | $200 | Still waiting…DONE! To transfer, go to top menu My HSBC, then Bank to Bank Transfers $1 per paycheck Still doing DD until December minimum to get $100  , , signed form is in Dropbox under…2020 taxes |

|

| US Bank | $300 | Started when? (check email) Closed w/ no fee | |

| Wells Fargo | $400 | When should I stop transferring $500 in per month? Closed? |

|

| Capital One 360 Performance Savings | $200/$10000 deposit for 90 days | Approved 11/15 Received bonus Feb 24 |

|

| Discover | $200 for $25000 cumulative deposits (can be in and out) | Applied & approved 11/14 $6k transferred 11/18 from NWPCU $6050 transferred back 11/23 Bonus received in 2019 Not closed as no fee |

|

| BBVA | $200 for one $500 DD, $50 for savings keeping | Keep account open (with $20?) until 1 year later | Applied July 24 {{ :everyday:money:disclosure.pdf |}} |

| Bank of the West | $1000 DD per month for 3 months = $250 | Any DD per month avoids fee. Worried that outgoing transfer will cause fee. Use Zelle instead?disclosure-oregon.pdf | Stopping transfers end of February after 91 days. Maybe transfer $1 per month from DD at that point? Bonus of $250 received April 15 Leave open? Still doing DD for no reason |

| Homestreet Bank | $350 | $3K direct deposit in 90 days Hold $2.5K per month for no fees Keep acct open for 240 days for $350 reward Don't cancel before 365 days or else they reserve the right to ask for bonus back Can transfer money using Paypal | Approved Nov 19 2019 Waiting for signature card to send in DD |

| Columbia Bank | Have to go into bank Do $1 DD from work per month | Deposited March 13 Keep $1 DD / mo Removed $200 bonus in April Still doing DD for no reason | |

| KeyBank or use Dad's referral code | $500 direct deposit for $400 $500 worth of transactions a month to avoid fee Money within 60 days, don't close before 180. | $500 DD'ed, need to transfer out using Paypal. December 15, transfer $500 in/out Didn't actually DD $500, did $400 Trying to close account in July |

|

| Citi | $15K for 60 days, $10K for 90 days to avoid $25/mo fee. $400 | Cancel after 90+60 days | Transfer $14999 into savings, $1 into checking. Bonus received April 15. Cancelling once money is mostly transferred out Closed May 19 2020 |

| Charles Schwab | $1k deposit / $100 | Keep account open to not get bonus charged back | |

| Incredible Bank | Two $300 DD within 30 days (maybe NW Priority would count?) Wait until $175 | ||

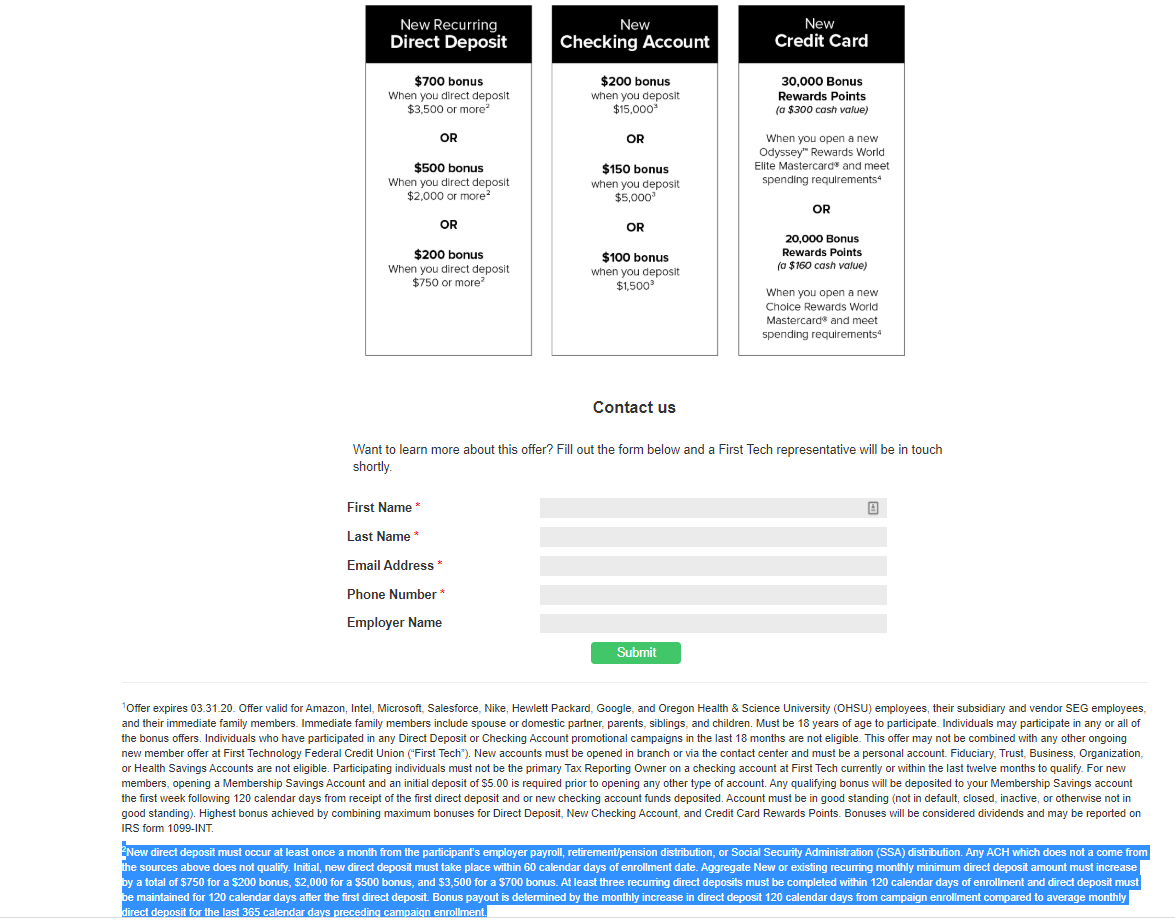

| First Tech Credit Union |  | Started. Should be ok for 60 day thing. Keep up direct deposit for 120 days total but don't need to keep balance in checking | |

| SoFi Bank | $75 for two $500 DD within ?? days Also 5% back on debit card for first 90 days | Signed up May 5 and set up DD | |

| Rivermark Credit Union | $100 for signing up with checking account Note to self, write down T&C. I missed doing a $100 opening deposit? | Done May 5. Need to transfer some money | |

| Capital One Checking | $250 for $1500 spend on debit card | Signing up 11/2020 |

Speaking of which, early account closure fees for the other banks I've done…?

Credit Cards

After talking with Glenn, we realized that for me it's not about the money. It's about “if there's a better way to do something, I want to know about it” / “puzzle solving” / “winning”. At some point it becomes unwise to spend hours optimizing a few dollars. But if it's boring stuff, paying me money won't help.

Interesting side note, different names for the same thing:

| Name | Feeling |

|---|---|

| Losing money | Oh no! Panic |

| Inflation went up 2% this year | Bummer, but can't do anything about it |

| Save money! | AWESOME! GOTTA HAVE IT |

| I will pay you money for work | Ok, kinda cool. Is it boring work? |

- Similar for credit cards: all those 1.5% Cash Back and $200 sign up bonuses? They come out of the 1-2% transaction fee that vendors pass onto you (and cash payers) and the $20-40 normally silent (opt-in!) overdraft charges that poorer people generally pay. Interesting. Somewhat good article

- Better article from reddit: https://www.reddit.com/r/churning/comments/5oucdq/the_economics_of_churning_who_pays_for_the_rewards/ and 1, 2, 3

- Visa doesn't allow the merchant to discriminate between the different charges, or “no surcharge rule”

Type Fee Cash (N/A) No fee Debit Card (from a large bank) 0.05% + $0.21 per transaction Debit Card (from a smaller bank) 1.15% + $0.15 per transaction (capped at $0.35) Basic (no rewards) Credit Card 1.22% + $0.05 per transaction Traditional Rewards Credit Card 1.48% + $0.10 per transaction Signature Credit Card 1.48% + $0.10 per transaction Signature Preferred Credit Card 2.10% + $0.10

- So cash and debit users end up financing the rewards points of high interchange fee users, to the tune of ~$130 per person per year flowing to $1200 per high rewards card user per year. (10X more cash/debit people than “rich”??!)

- On the other hand, lots of money is flowing from the rich to the poor in the form of progressive income taxes and luxury goods taxes. So it kinda evens out?!

- Interesting looking paper that I'll probably never get to: “The Economic Effects of Interchange Fees”, by Al Frankel and some other guy. http://c0462491.cdn.cloudfiles.rackspacecloud.com/Frankel.pdf. Also the original DOJ paper: http://www.gao.gov/assets/300/298664.pdf

CARD Act of 2009

Pretty cool…

https://www.credit.com/credit-law/credit-card-act-of-2009/

Relevant for me: No fees for not using card (inactivity fee), clear statement of how long it will take to pay off debt with just minimum payments and how much money goes to interest. Cool.

Business cards

Yes you can, and can use personal expenses somehow, but need >$1000/year in revenue. https://medium.com/optimalist/you-can-apply-for-business-credit-cards-4384535333d7

Magic American Express Number

My Delta card had a $1000 credit limit for the first 60 days. However, if you called 1-800-230-1284, they were able to deduct from my checking account on file immediately the amount needed to book my flight so I could get a increased credit limit! I.e. transferring in money so you have a balance and thus more of a credit limit, except instantly and magic-like.

Yearly Fee

Can supposedly transfer the points to a non-yearly-fee card or downgrade your account? Will need to look into.

Rejections

![]()

From Ally Bank:

- LACK OF RECENT INSTALLMENT LOAN INFORMATION

- LENGTH OF TIME ACCOUNTS HAVE BEEN ESTABLISHED

- TOO MANY INQUIRIES LAST TWELVE MONTHS

- TIME SINCE MOST RECENT ACCOUNT OPENING IS TOO SHORT

- How short is too short?

BofA:

- No more than 2 in 2 months, 3 in 1 year, etc. Something like this.

Capital One:

- Based on your credit report from Trans Union,number of bank cards tradelines opened in the

last 24 months

- Means 5/24?

Also credit score is 750 right now. Not great, better lay off for a while…next spring maybe.

Credit Score / Underwriter Eyebrows

There are 2 main different scores. FICO and VantageScore. FICO seems to be 10 points less than the others.

http://CreditKarma.com is excellent for explaining these visually. CalcXML has a good calculator to play with knobs, MyFICO has less accessible knobs. CreditKarma has a good simulator too. “Credit Score Simulator”

No real difference >760 when applying for most normal loans.

| Thing | Details |

|---|---|

| AAoA (Average Age of Accounts ) | Older = better, and averaged based on the number of open accounts AR: Leave several open for a long time so new CC offers don't affect it. >7 years is best |

| Closed accounts | Let you sign up for the card again ~2 years later. But, actions stay on your account for 10 years. Increases AAoA by removing new accounts, but indicates you are not loyal. Might want to keep a few more open than just 1. |

| Hard inquiries (needed to get loans / CC of any kind) | Low impact to score, but go away after 2 years. So if you have a looming house purchase, think twice. Also, don't let car sales people do a hard inquiry on you each time for a loan. Tanks your score! |

| History |

Credit Card

- Don't close them! Age of credit is much more important than getting the rewards again. You don't want the hit to your credit score…

Can close accounts, as long as you have an old account….something like that. We'll see. Do it after Poland trip since it seems easier on the mind.

- Keep using them, probably once a year?

- Can spread out applications to various folks, although getting a Chase card would be nice. https://thepointsguy.com/guide/credit-card-application-restrictions/

- Capital One

- Apparently doesn't reject you for having 2 credit cards with them already. Only 5 total though?

- Also, I seem to be able to apply for a 2nd Savor card.

- Can only get 1 card with them every 6 months. https://www.doctorofcredit.com/capital-one-tightens-churning-rules/

- To minimize estimated tax expenses on the CC, only do the minimum needed. (min-plane ticket) Can buy the plane ticket and have that count for the minimum too.

Currents

| Name | Notes | State | Number | |

|---|---|---|---|---|

| Capital One Quicksilver | Keeping for long age of accounts. $12 remaining | 4463 | ||

| Capital one Savor | Close next week to get big Capital One card | 9430 | ||

| HSBC Cash Rewards | Keep open for AAoA and end of year bonus. $20 credit remaining | 6155 | ||

| Bank of America MLB | Keep open? | 6831 | ||

| Bank of America Cash Rewards | Keep open? | 3734 | ||

| Wells Fargo Cash Wise | Keep open? | 7850 | ||

| BarclayCard | $5000 / $700 (70k points) | Approved! Feb 9 2019 | 7647 | |

| Citi AAdvantage … can apply separate from Citi Premier and still get signup bonus avoiding 24-month rule. https://onemileatatime.com/citi-card-24-month-rule/ | Having issues redeeming.\\Want to create an AAdvantage account, but it says there's already one with my name on it.\\Need to call… Annual fee | 8115 | ||

| US Bank Cash Plus | $150/$500, but rewards expire in 36 months Approved Aug 2018 | 3093 | ||

| Wells Fargo Propel | $300 / $3k. $0 annual fee | Approved July 2019 Use to churn on tax payment 0% APR until August 2020. Autopay min | ||

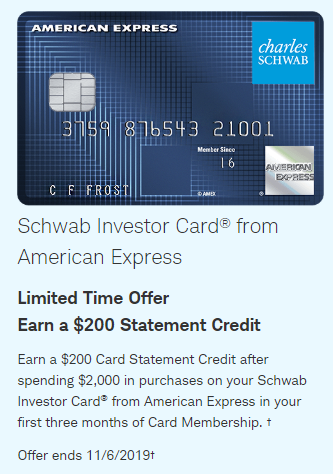

| Schwab | $2000/$200  | Approved October 2019 0% APR until … May 2020 $200 bonus deposited | ||

| Fidelity Card? | $1500/$150, no annual fee 2% cash back, Quicksilver replacement… | Approved November 2019 No APR reduction Received $180 Dec 31 2019 | 8780 | |

| Alliant Credit Union targeted? offer | $3K/$200 Not much, but not much else either | Approved Nov 19 2019 Need to probably spend in Q1 When will it show up? | ||

| American Express Delta Gold | Targeted $2K/70K miles + $50 statement bonus + perks Got because of work delta purchase ~$100 annual fee | Approved Dec 31 2019 $2K reached on 80K points deposited | ||

| PNC Bank Core CC | Targeted? $1K/$100 | Approved Jan 13 2020 | ||

| BBVA Bank | $1500/$100 | Approved Jan 28 2020 $100 received |

Closed

| Name | Notes | State | Number |

|---|---|---|---|

| Citi Premier, maybe AA cards? | $4000 / $625 on airfare, $850 if on preferred list, which includes AA. Have to book through Citi Travel center for 1.25X points, but doesn't seem to have exact flight, but can book individually for about the same price. So decide if you really want to come back that day or stay longer… | Closed Jan 2 2020 | 7682 |

| US Bank Altitude Reserve | $400 annual fee, but $375 in travel credit + 50K points Doctor of Credit Approved July 2019 Apply for Global Entry on receipt, wait to churn on tax payment Priority pass lounges (4 free for cardholder, 4 for guests) $28 value each flight on same day | Cancelled July 2020, supposedly posted annual fee is cancelled Sarah 200708026136 | 9516 |

On Deck

Maybe I just want to just save up for Chase 5/24 for FI! Maybe do one good card a year for travel, otherwise do cash quarterly tax payments. Most of the cards only give .5c/point for cash and they're just not as good as chase.

Annual fee is 0 for first year.

Maybe annual fees are worth it sometimes.

- Only if you're planning on doing the traveling. Otherwise it feels like a pain. If you pay it with after-tax money and if you pay it from the bonus miles, then you have to pay up…now!

Check this site for latest: https://www.doctorofcredit.com/best-current-credit-card-sign-bonuses/

Can also sign up for several smaller cards…

| Name | Amount | Notes | |

|---|---|---|---|

| First Tech CC's | $2000/$300 | Rejected Jan 2020, Length of time revolving account established Lack of recent installment loan Too many inquiries last 12 months Length of time accounts have been established Too many accounts recently opened | |

| Discover It Miles | $0/$100 referral + 3% | Rejected Jan 2020 | |

| Keep a paid off travel card on hand for surprise trips? One with no annual fee | |||

| US Bank Cash 365 | $500/$150 cash, no annual fee | Rejected Nov 2019, too many tradelines opened in past 12 months. Wait for 6-12 months? | |

| US Bank Radisson | $3K spend / 120K+15K points = ~$400 towards Radisson hotels or $200 in cash | Could use for Germany, but not sure I will have points in time and probably won't get approved | |

| Blue Cash Preferred | $1000/$300, but $95 annual fee | ||

| | $2500 / $220 in gift cards + $100 in airfare. | ||

| Elements Financial | $1000/$200 | Applied. Need 10 payments totaling $1000. Also savings account active with direct deposit. No closing before 6 months. Not a problem. Denied Oct 2019 Lack of recent installment loans Too many inquiries & lack of time opened Time since most recent account opening is too short | |

| Amex Blue Cash Also cash magnet card | $1500?/$200 | Denied Oct 2019 The number of creditors who have reviewed your credit report. The length of time you have been a customer with American Express is too short. | |

| US Bank FlexPerks Travel Rewards Visa | $2000/$375 travel | No annual fee 1st year | |

| Wells Fargo Cash Wise | $500/$150 cash | No annual fee. Eligible in … 15 months … Nov 2020 | |

| $3000/$300 travel | No annual fee first year | ||

| Frontier Card ? | 40K points, but $75 annual fee | ||

| HSBC Premier World | $3000 / $400 airfare | Nope! Need to be Premier checking, which is a lot of hassle at this point. $5K monthly transfer in | |

| Capital One Venture / Savor | $500/$3k, $500/$3k | Shortly? Denied Fall 2018. Denied June 2019. | |

| | Always have annual fee, no waiver | ||

| Capital One Business | $500/$3k | Save for after Venture is done?? That'll work…\\want to keep quicksilver open | |

| Bank of America Premium Rewards | $500/50K + $200 unnecessary flight stuff, but annual fee of $100 | Rejected July 2019 due to Too many recent accounts Limited deposit and/or investment balance |

List of Potentials

Use friend referral bonuses from reddit or something, split them?

| Name | Bonus | Period used |

|---|---|---|

| Chase higher spend cards for tax payment (Chase Sapphire Preferred) buy through someone else | 2-3X * $500/$4000 | Basically when used for travel, can get 2-3X cash value https://www.choosefi.com/travel-rewards-part-3-sweet-redemption/ |

| Chase Cards, including Amazon, AARP. and Chase Freedom (non-unlimited) card | $50/$0, $200/$500, $150/$500 But they follow 5/24 rule, 5 cards from ANY bank in last 24 months. | |

| Southwest!! | $200/$500 + 10K points (2 one-way flights to CA) - $79 annual fee | Don't need yet, but probably will someday |

| Southwest cheaper yearly fee (RapidRewardsCard.com) Invitation Number: 5650 1948 3298 | $100 + 40K points / $1K in 3 months - $69 yearly fee | |

| HSBC Advance Mastercard® credit card | $0 intro. | |

| BankAmericard Mastercard (Susan G Komen, MLB, WWF, etc) | $150/$500!! Wow… And…it gets better! If you have $100K with Merrill Edge account, then you get 75% bonus on rewards, maybe even the $150 initial reward. That's all of … $100 ?? Hmmm. Also, you can't buy VTSAX from it, but you can transfer it. Hmm… https://www.frugalprofessor.com/financial-update-jan-2018/ | MLB got Feb 10 2018 in advance of medical bills and California trip. Received 6 days later! However they limit to 2 cards in 2 months, 3 cards in 12 months, etc. Applied in May and August 2018, rejected both times |

| American Express Blue cards, some have no annual fee | $200/$1000 | |

| | $200/$1000 | |

| | $150/$500 | Apply for Poland trip, no foreign transaction fee. 1-888-751-9000 Have to be in a state with TD Bank help page article |

| BMO Harris | $100/$1000 | |

| Key Bank | No signup bonus | |

| Ally Bank Credit Card | $100/$500 | Password is your childhood self-assigned nickname. 1-888-916-ALLY(2559). https://www.ally.com/credit-cards/cash-back-credit-card/ Applied in March 2018 , got rejected for too often. |

| HSBC Platinum Mastercard® Cash Rewards Rewards card | $150/$500 / $150 points / $500 | Got the cash one! Not sure about points one, but seems good Reviews online say setting up account sucks. http://disq.us/p/1sj9acu |

| Santander Bank | $100/$1000 | |

| Bank of America Cash Rewards Card | $150/$500 | Got it, spending now. Set up e-bill so it'll pay automatically. |

| Capital One Premier Dining Rewards | $100/$500 | Have it already |

| Citi cards | 25-30K miles / $750 | Maybe I do want miles…hmm…AA. |

| Capital One VentureOne Rewards | 20K miles / $1000 | |

| Macy's Card | a good bit | Closed 7/8/2017 |

| Wells Fargo Cash | $200 for $1000 | 10% bonus if deposited to their checking account, but requires minimum balance of $1500 to avoid $10/month service charge. For $20, not so worth it. Bonus hasn't showed up yet, wait a billing cycle or two (mid-august), also might need to spend $500 more to get $7 to get $25 multiple of redemption. But might not be worth it! |

| Chase Freedom Unlimited | $150/$500 | Closed 7/10/17 Don't close unless you're paying a fee! Not worth it |

| Capital One Quicksilver | ??? | Long-term |

Bonuses

- The clock apparently starts ticking when you are approved, not when you activate the card.

- Also, it can be not very fun after a while to just churn cards. Takes time and energy.

Cash

Nice search: http://www.magnifymoney.com/compare/cash-back-credit-cards/

http://www.creditcards.com/cash-back.php and maybe nerdwallet, or support Mad fientist: http://madfientist.cardratings.com/

An alternative is to go for the cash cards. Which, I just did. Chase card for $150, spending $500 in 3 months. And just need to cancel after that and wait 24 months to reapply and get bonuses.

- Let's just do one per quarter for now to make sure I meet it.

Miles

Pretty good article: http://www.nomadicmatt.com/travel-blogs/travel-hacking-1-million-miles-per-year/

- Basically is only helpful for the sign up bonuses. So if you know you want to fly 6 months to 1 year in advance, you can sign up for a new card, spend $1,000 in 3 months (manufacturing spending or paying taxes with 1.87% fee (but you can't do it with Intel at least)), wait 8-12 weeks to get the bonuses, then cancel within 30 days of the yearly fee showing up.

- I think in my case, I don't know that I will fly that far ahead of time. And…I really value simplicity.

- It's kinda like “candy/lust now” or “satisfying real food / relationship after lots of hard work”

NerdWallet does a decent job of comparing cards, but neglects to mention the Citi Double Cash, but the rewards expired at 1 year if you didn't spend more than $25 worth of rewards.

- Dropping PNC.

- Ask people over the phone, “is there anything else I should know about the card?”, or, See if they will admit to points expiring, etc, other fees